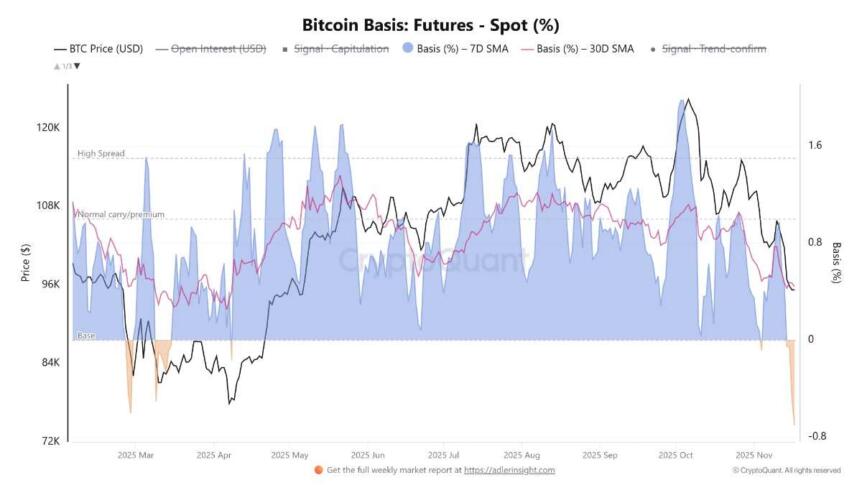

Recent shifts in the cryptocurrency market highlight a growing cautious sentiment among traders, as the Bitcoin futures-to-spot basis has turned negative for the first time since March 2025. This development suggests a potential cooling of investor enthusiasm, with traders showing a preference to de-risk amid increasing market volatility. The trend underscores ongoing uncertainty in the crypto markets, impacting Bitcoin’s price outlook and trading dynamics.

- Bitcoin futures-spot basis has dipped into negative territory, signaling increased caution among traders.

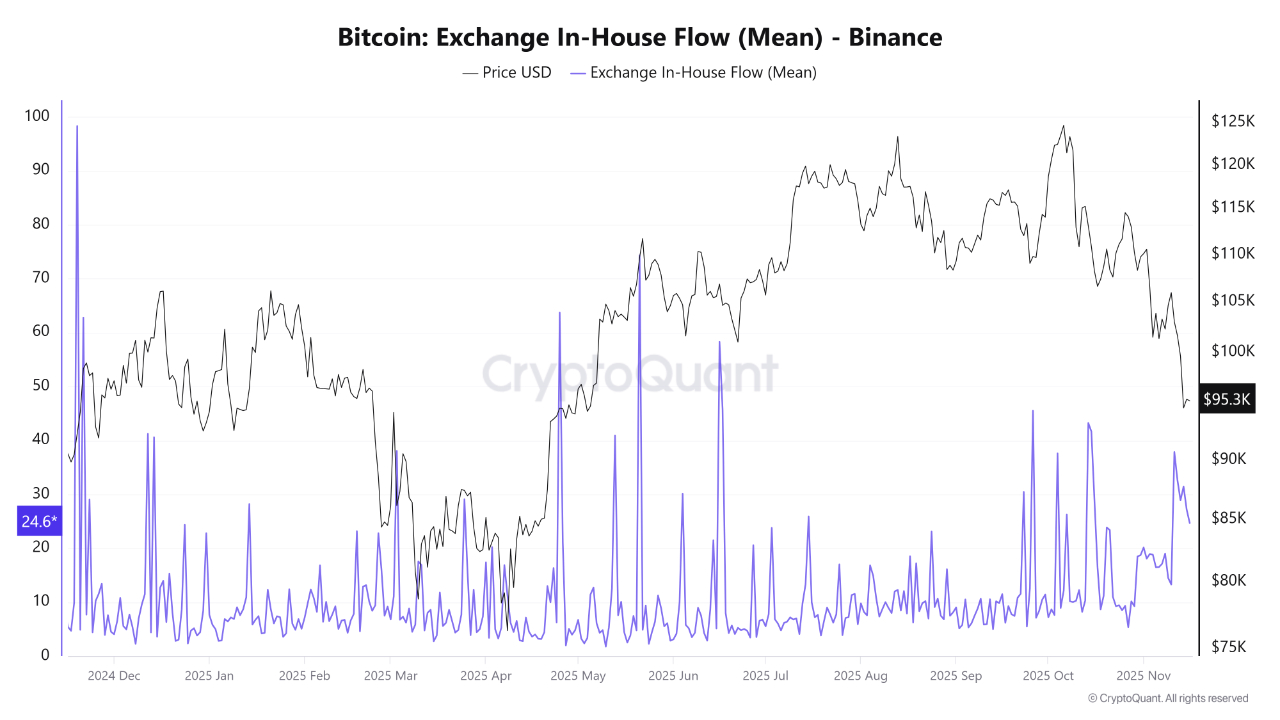

- Internal exchange flow surges often precede heightened volatility and liquidity stress.

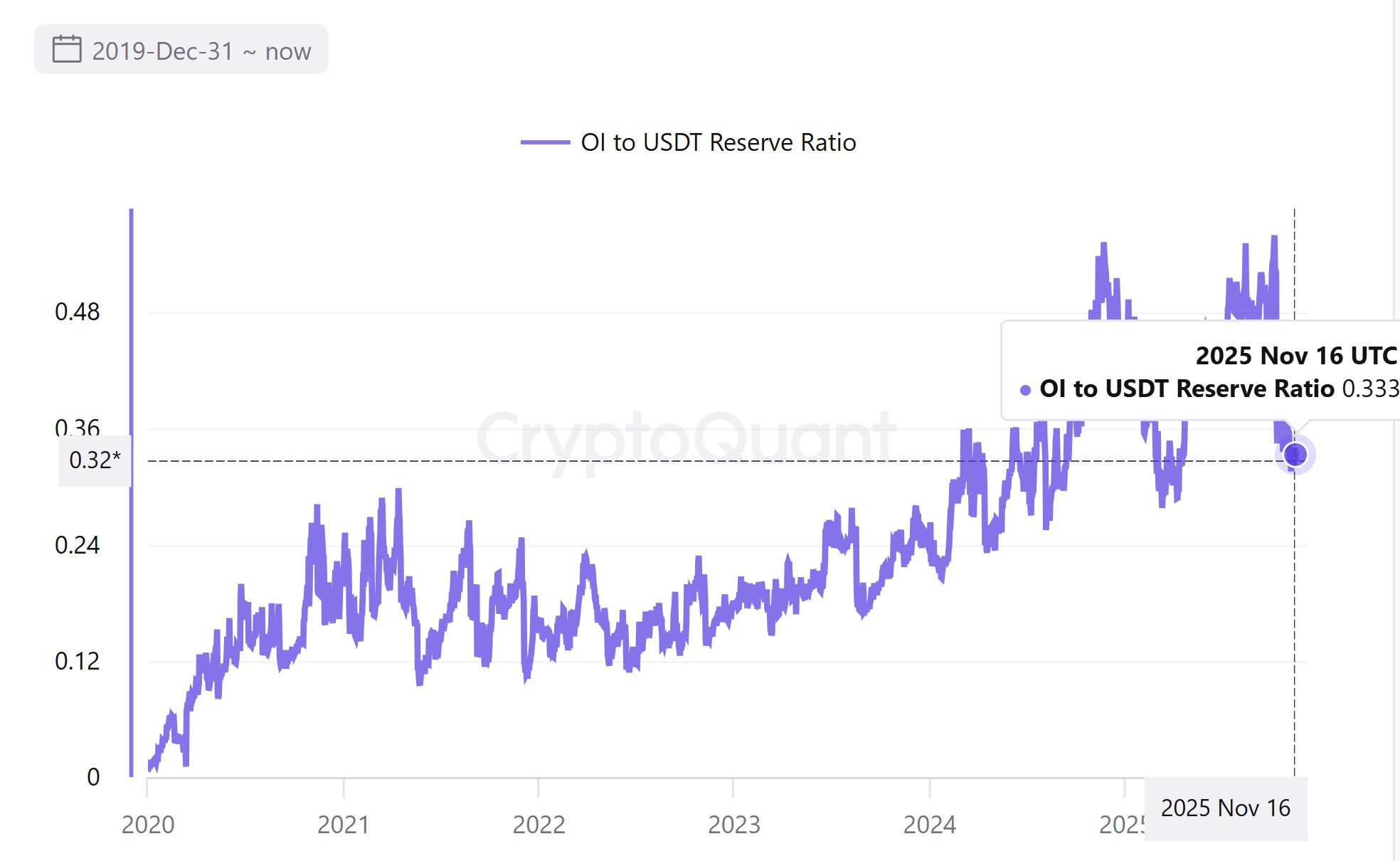

- The market’s leverage ratio has decreased, indicating a healthier futures environment and reduced forced-liquidation risks.

- Historical patterns of negative basis may point either to a market bottom or further downside, depending on subsequent price movements.

Bitcoin futures-spot basis signals two different pathways

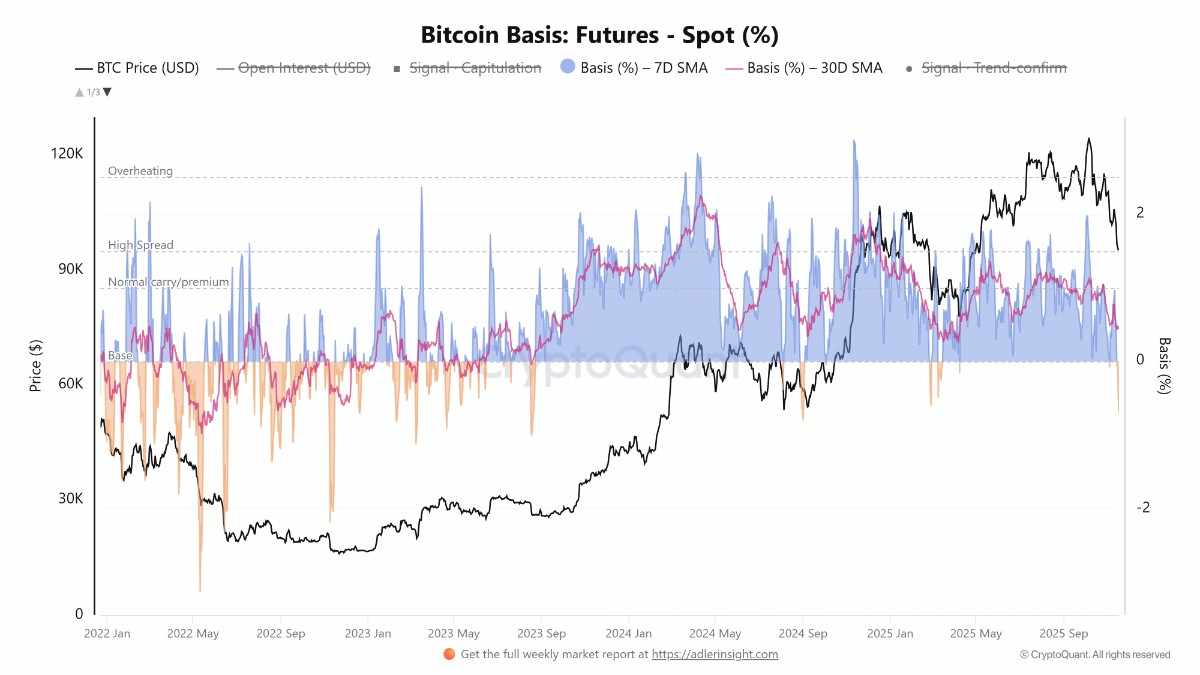

Bitcoin’s recent turn into a negative futures-spot basis, where futures trade below the spot price, marks a critical phase that often signals market caution. Currently residing within the “Base Zone,” a range associated with increased selling pressure, the seven-day and 30-day moving averages are trending downward, indicating a bearish tilt. Such a trend suggests that traders are becoming more risk-averse, likely preparing for increased market volatility.

Historically, when the seven-day SMA turns negative, it has often coincided with bullish bottom formations during bull markets, hinting at potential recovery points. Conversely, during bear phases, this same signal can forecast deeper declines, especially if the basis remains below 0%. A move back above the 0.5% range would signal renewed confidence among traders.

Additionally, the BTC-USDT futures leverage ratio has dipped toward 0.3, reflecting a reduction in previously overheated leverage levels from Q2-Q3. This decline suggests less pressure on liquidations and a healthier futures environment. If bullish momentum resumes, this cleaner leverage backdrop could support a bullish re-entry, offering traders more room to take on risk without the fragility seen earlier in the year.

Search for Bitcoin bottom continues

Crypto analyst Pelin Ay emphasizes that exchange in-house flow metrics bolster the ongoing downside narrative. Sharp increases in internal transfer volumes often mark turbulent periods or shifts by major players, especially when accompanied by declining prices.

Recent surges in internal exchange flows, especially from late 2024 through 2025, have historically flagged periods of liquidity stress and increased volatility. The latest spike, coinciding with Bitcoin’s decline from over $110,000 to $95,000, reinforces the ongoing search for a market bottom. As the crypto markets continue to grapple with macroeconomic uncertainties and evolving regulations, traders remain cautious, awaiting clearer signals of a sustainable recovery.

For updates on Bitcoin’s prospects and the evolving landscape of crypto regulation, market participants are advised to closely monitor on-chain signals, leverage ratios, and futures market dynamics. Understanding these key indicators is essential for navigating the unpredictable crypto environment amidst ongoing regulatory developments and technological innovations.

This article does not constitute investment advice. Cryptocurrency markets are volatile, and trading involves significant risk. Readers should perform their own research before making any investment decisions.

https://www.cryptobreaking.com/what-does-it-mean-when/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=What%20Does%20it%20Mean%20When%20BTC%20Futures%20Turn%20Negative%20Compared%20to%20Spot%20Price?%20

Comments

Post a Comment