Recent initiatives highlight how blockchain and decentralized finance (DeFi) could play a pivotal role in addressing economic disparities. Advocacy organizations are emphasizing the potential for crypto technology to reduce costs for vulnerable populations, offering hope for greater financial inclusion amid evolving regulatory landscapes.

- DeFi could save unbanked and underbanked populations around the world approximately $30 billion annually by lowering remittance and transaction costs.

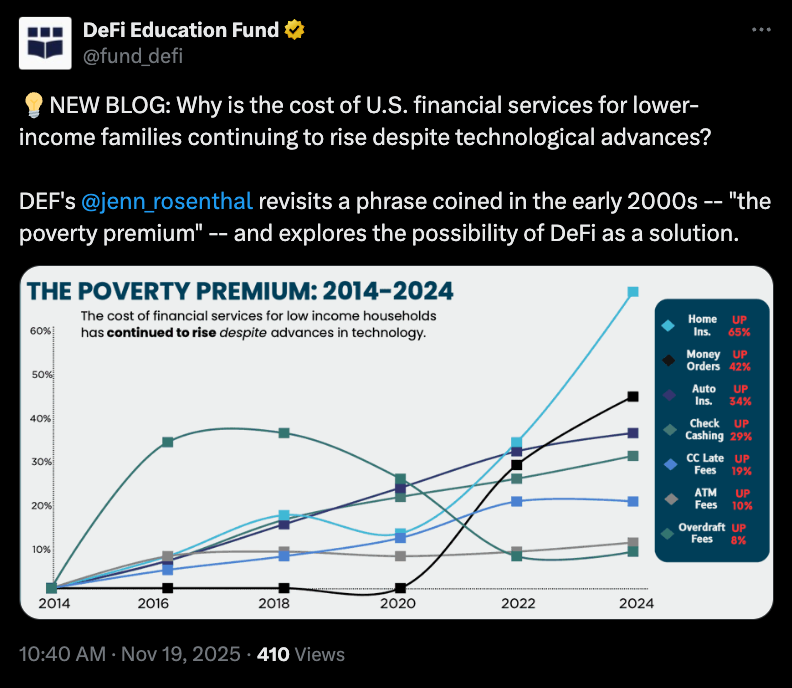

- Advocates argue that removing intermediaries in financial services could significantly reduce the "poverty premium" faced by low-income households.

- Despite limited familiarity with DeFi among Americans, there is strong interest in its core features, such as financial control and data security.

- US policymakers are advancing toward a comprehensive digital asset regulation framework, with bipartisan efforts ongoing in Congress.

- A new market structure bill aims to provide clarity for cryptocurrencies, potentially becoming law by early 2026.

The DeFi Education Fund, an influential organization dedicated to promoting decentralized finance, is exploring how blockchain technology can be harnessed to alleviate poverty both in the United States and globally. In a recent blog post, the group outlined how DeFi infrastructure could trim around $30 billion in annual costs for unbanked and underbanked individuals worldwide, primarily through lowered remittance fees. This reduction could cost savings of up to 80% for workers sending money home and paying transfer fees, transforming the financial landscape for many underserved communities.

“The poverty premium persists because the current, layered, and often outdated financial infrastructure makes serving low-income families unprofitable,” said the DeFi Education Fund. They added,

“While nothing in finance is free, DeFi doesn’t eliminate all costs, but by removing intermediaries and leveraging software, we can dramatically lower the cost of financial services and empower individuals with more control over their finances.”

Proponents across the crypto space have long proposed that blockchain applications can address poverty by reducing transaction times, decreasing or eliminating fees, and expanding access to essential financial services. For example, high costs associated with cashing paychecks without bank accounts, using money orders, or owning property could be mitigated through DeFi solutions, making financial inclusion more attainable.

Interestingly, only about 3% of Americans are highly familiar with DeFi currently, but a majority show openness to its core benefits. Over half of U.S. adults value having control over their funds and data security, with more than half wanting to access their complete financial history at any time. This suggests a significant potential for DeFi adoption if regulatory and educational hurdles are addressed.

Looking for policies and laws favorable to DeFi

In the United States, legislative efforts are nearing the debut of a comprehensive digital asset market structure bill. Both Republican and Democratic lawmakers are working on drafting legislation that could provide regulatory clarity for cryptocurrencies and DeFi protocols. However, disagreements remain; some Democrats have proposed restrictions on certain decentralized finance activities, aiming to prevent misuse while fostering innovation.

The proposed market structure bill, delayed by a recent government shutdown, is expected to advance into law early next year. Senate Banking Committee Chair Tim Scott anticipates that the legislation could be signed into law by early 2026, potentially marking a turning point for crypto regulation and the broader blockchain economy.

As regulatory frameworks develop, the crypto industry continues to advocate for policies that foster innovation while safeguarding investors. The alignment of regulatory clarity with the promise of DeFi's potential to reduce financial inequality remains a key focus for stakeholders in the rapidly evolving crypto markets.

https://www.cryptobreaking.com/advocacy-group-unveils-defi-solutions/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Advocacy%20Group%20Unveils%20DeFi%20Solutions%20to%20Fight%20Global%20Poverty%20

Comments

Post a Comment