Bitcoin Core has successfully undergone its first comprehensive third-party security audit, a significant milestone that underscores the software’s robustness within the blockchain community. The review conducted by French cybersecurity firm Quarkslab, commissioned by OSTIF on behalf of Brink, affirms that Bitcoin’s core software is highly mature and resilient, supporting the continued trust in what remains the world's largest decentralized cryptocurrency network.

- Bitcoin Core’s codebase, over 200,000 lines of C++, confirmed as highly mature and well-tested through an extensive audit.

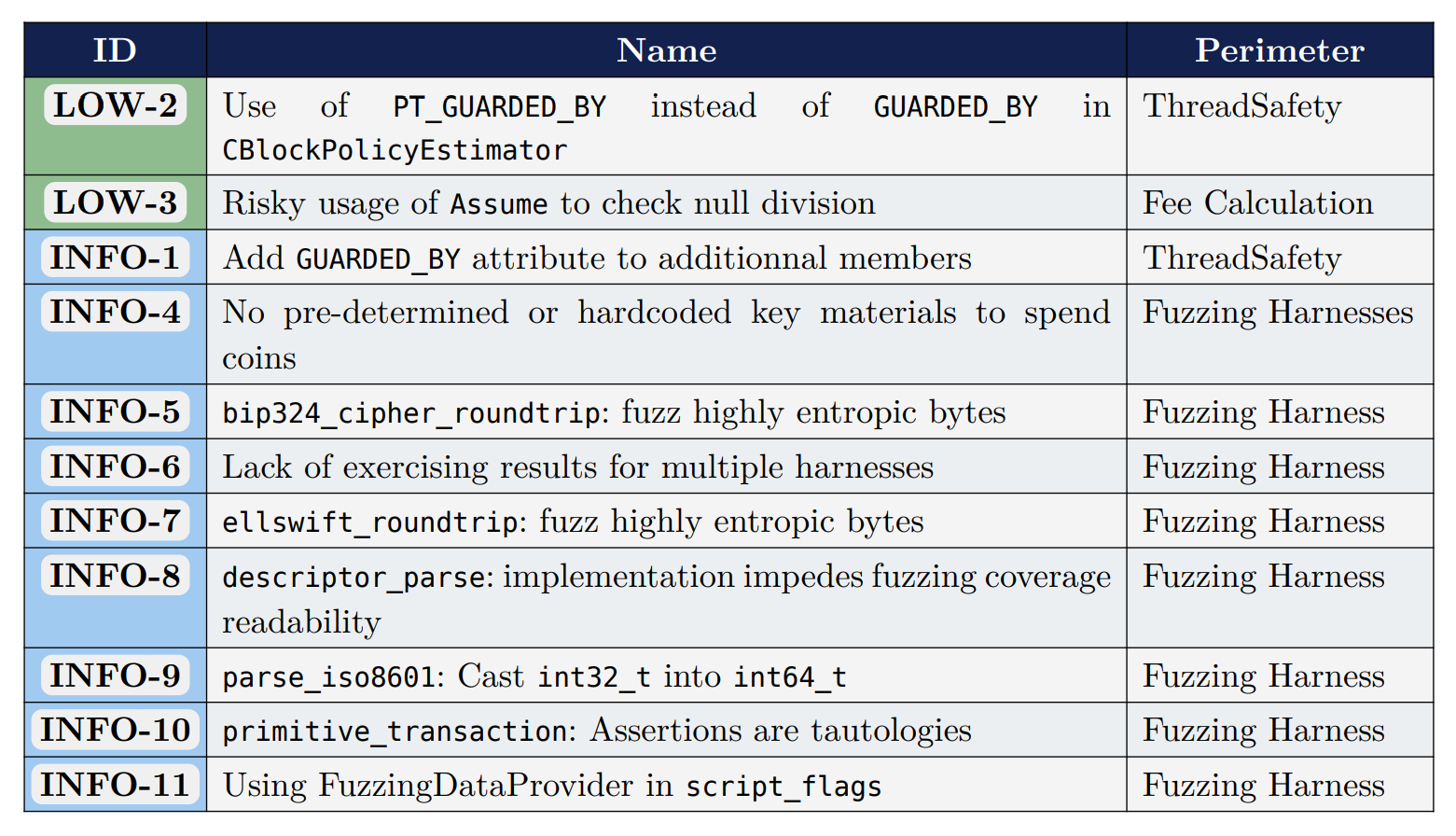

- No critical or high-severity vulnerabilities were uncovered, with only two low-severity issues identified.

- The review emphasized the security of Bitcoin’s peer-to-peer (P2P) layer and block validation logic.

- The findings highlight the importance of ongoing testing and refinement, especially related to fuzzing and test coverage.

- The audit occurs amid ongoing debates within the Bitcoin community regarding blockchain data restrictions and network openness.

Security Audit Confirms Bitcoin Core’s Resilience

Bitcoin Core’s first independent security review marks an important step in validating the software securing the world’s largest cryptocurrency network. The audit focused on critical components, including the peer-to-peer (P2P) networking layer and transaction validation logic, over 104 days spanning from May to September.

The auditors praised Bitcoin Core’s codebase, describing it as “the most mature and well-tested,” despite its considerable size. The review evaluated more than 200,000 lines of C++ code, complemented by over 1,200 tests already implemented. Their findings confirmed the software’s resilience, as no high- or medium-severity vulnerabilities were discovered.

Among the identified issues, only two were considered low-severity, mainly related to fuzzing tools and test coverage improvements. Critically, none of the issues posed any threat to network consensus, resilience against denial-of-service attacks, or transaction validation processes.

Reviewers Confirm No Exploitable Bugs

The review extensively examined Bitcoin’s P2P network layer, responsible for relaying blocks, transactions, and peering across roughly 125 connections per node. The auditors found no cases where malicious data could slip through validation or disrupt network operations by bypassing ban mechanisms.

Further assessments included mempool handling, chain-state transitions, and chain reorganizations—areas where potential bugs could jeopardize network stability. No exploitable vulnerabilities were identified in these critical processes.

“No significant security issues were identified. Most recommendations focus on refining existing fuzzing tools to enhance their effectiveness and test coverage,” the report noted.

The Ongoing Bitcoin Community Debate

The audit’s release coincides with the ongoing debate between supporters of Bitcoin Core and Bitcoin Knots, sparked by the recent v30 update. The core dispute concerns whether non-financial data should be permitted on the blockchain, with critics warning that allowing such data could lead to spam and illegal content embedding.

Supporters of Bitcoin Knots argue restrictions are essential to prevent misuse, while Bitcoin Core developers emphasize that such controls could undermine network openness and neutrality — foundational principles of the blockchain ethos.

According to Galaxy Digital’s research chief Alex Thorn, most institutional Bitcoin investors remain largely unaffected by this dispute. A recent poll of 25 institutional clients found that nearly half were unaware of the debate, and just over a third expressed indifference. Only 18% of respondents sided with Bitcoin Core’s stance on maintaining blockchain openness.

https://www.cryptobreaking.com/bitcoin-core-audit-reveals-no/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Bitcoin%20Core%20Audit%20Reveals%20No%20Major%20Flaws,%20Confirms%20Robust%20&%20Mature%20Codebase%20

Comments

Post a Comment