In a notable development within the cryptocurrency sector, Bitwise Asset Management is preparing to launch a new spot ETF tracking XRP on the New York Stock Exchange. The ETF, which will trade under the ticker “XRP,” marks a significant step for the digital asset, despite stirring some confusion among market participants regarding the choice of ticker symbol. This move underscores the growing institutional interest in crypto assets and the evolving landscape of crypto ETFs, fueling further mainstream adoption and regulatory scrutiny.

- Bitwise to launch XRP spot ETF on NYSE, trading under the ticker "XRP".

- The ETF follows a trend of crypto-focused funds tracking major digital assets like Bitcoin and Ethereum.

- The ticker symbol "XRP" has sparked debate over potential confusion with the Ripple token itself.

- Additional XRP ETFs are expected, with industry analysts predicting more approvals soon.

- Market experts highlight XRP’s long-term potential amid a shifting regulatory environment.

Bitwise Asset Management has announced the imminent launch of a new spot ETF based on XRP, scheduled to go live on the New York Stock Exchange this Thursday. The ETF, listed under the ticker “XRP,” signifies a major milestone for the digital asset and its recognition within traditional finance markets. The move is part of a broader trend of mainstream financial firms launching cryptocurrency ETFs to offer investors regulated exposure to popular assets like Bitcoin, Ethereum, and now XRP.

Generally, crypto ETFs feature tickers that embed the asset's name or abbreviation—such as Fidelity’s FBTC or BlackRock’s ETHH—making the “XRP” ticker both fitting and potentially confusing among traders. Market participants immediately questioned the choice, with some expressing concern that the ticker might lead to misunderstandings, especially since “XRP” is also the name of the Ripple digital currency.

XRP ETF ticker is on-brand, but confusing

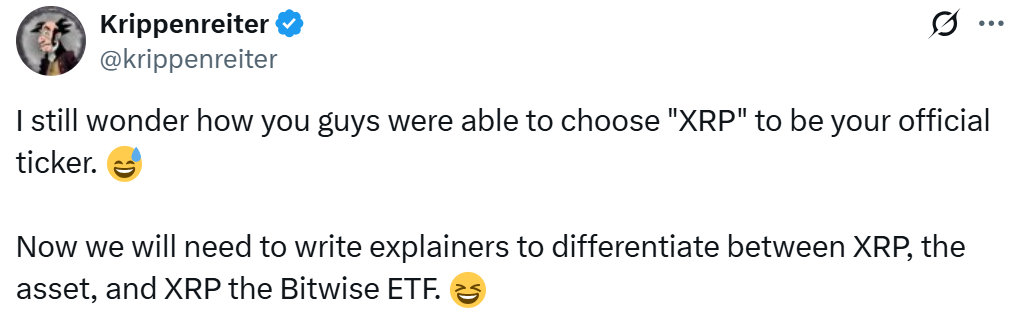

An industry observer, Krippenreiter, a known DeFi educator and technical analyst, remarked on the ticker’s potential for confusion. “How exactly did they choose XRP for the official ticker? Now we’ll need to write explanations differentiating XRP, the asset, from XRP the ETF,” they said, highlighting the ambiguity that might arise among retail investors.

Some users questioned the regulatory approval process, expressing skepticism about how the ticker was permitted. “Very confusing ticker symbol. How can that be allowed? There’s no ETF with the ticker BTC, is there?” queried one user, reflecting the concerns about clarity and oversight in crypto ETF approvals. Conversely, others congratulated Bitwise on securing the ticker, viewing it as a strategic choice.

Vincent Van Code, a software engineer, speculated that the ticker could be part of a broader plan. “That’s the point. Native XRP will become the wholesale token, while most retail traders will simply trade the ETF. Wholesale settlement, custody, and transfers—this is likely the end game for native XRP and the XRPL ecosystem,” they suggested, hinting at a long-term vision behind the branding choice.

Second XRP ETF for Bitwise

Earlier, in October 2024, Bitwise filed for its second XRP ETF with the U.S. Securities and Exchange Commission. Additionally, the firm launched the Bitwise Physical XRP ETP, trading under the ticker GXRP, across European markets in 2022. Industry experts remain optimistic about XRP’s prospects, citing its unique features such as high transaction volumes at low costs and a dedicated supporter base.

Matt Hougan, Bitwise’s chief investment officer, emphasized XRP’s potential, stating, “XRP is a really intriguing asset because it operates successfully over a long period, with high transaction capacity and a vibrant community of supporters.” He added that the new regulatory environment ensures XRP’s position is more equal among digital assets, allowing markets to better assess its capabilities.

“In the new crypto-forward regulatory regime, XRP stands on an equal playing field with other digital assets. Now the market will have the opportunity to see what XRP can really do.”

More XRP ETFs incoming

Following the debut of the Canary Capital ETF XRPC on November 13, which attracted over $250 million in its first day, industry analysts expect more XRP ETFs to launch soon. Bloomberg ETF analyst James Seyffart predicts the likely approvals of funds from Grayscale and Franklin Templeton by late November, indicating a burgeoning interest in XRP among institutional investors.

With the U.S. government shutdown now resolved, Hougan forecasts a surge of over 100 new ETF launches, signaling a vibrant phase ahead for crypto markets and blockchain-enabled investments.

https://www.cryptobreaking.com/bitwise-xrp-etf-launch-sparks/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Bitwise%20XRP%20ETF%20Launch%20Sparks%20Community%20Questions%20Over%20Ticker%20Choice%20

Comments

Post a Comment