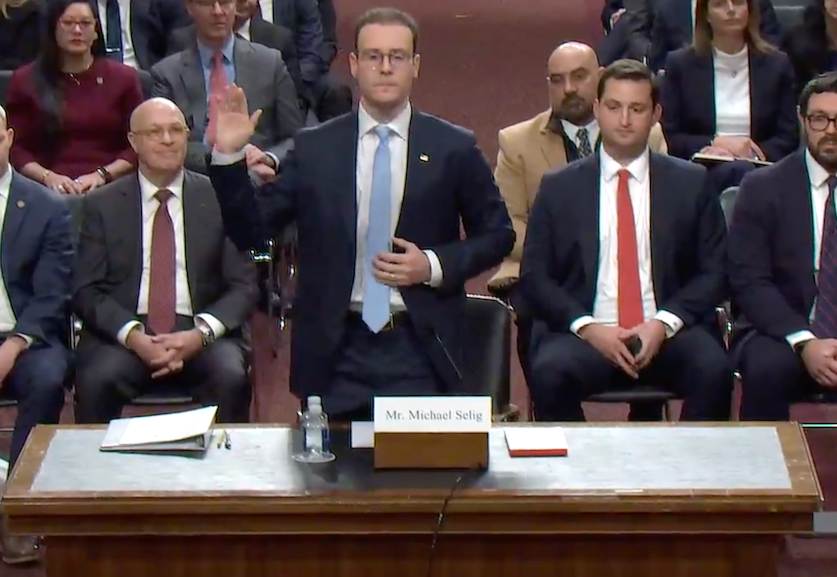

The upcoming confirmation of Michael Selig as the new chair of the Commodity Futures Trading Commission (CFTC) signals a significant shift in the regulatory landscape for the digital asset industry. Currently serving as chief counsel for the crypto task force at the SEC, Selig’s bipartisan hearing sheds light on his approach to crypto regulation amid growing debates over DeFi, spot commodities, and market oversight. His appointment could influence the trajectory of cryptocurrency regulation in the United States, affecting markets, innovation, and compliance moving forward.

- Michael Selig, SEC crypto task force chief counsel, advances as CFTC chair nominee amid congressional scrutiny.

- Selig emphasizes a balanced approach, warning against heavy-handed regulation and advocating for innovation-friendly policies.

- He discusses the role of the CFTC in regulating digital commodities, including spot markets and decentralized finance (DeFi).

- Lawmakers express concerns over CFTC leadership gaps, with acting Chair Caroline Pham expected to resign upon Selig’s confirmation.

- The confirmation process includes broad discussions on crypto enforcement, policy direction, and agency authority.

Michael Selig’s nomination to lead the CFTC was the focal point of a Senate Agriculture Committee hearing this week. As the head of the SEC’s crypto task force, Selig’s background in digital assets and market regulation positions him as a key player amid ongoing debates about crypto markets and regulatory reach.

During his testimony, Selig highlighted his experience advising diverse market participants, including digital asset companies, and cautioned against a solely enforcement-driven regulatory approach that risks driving innovation offshore. “We’re at a pivotal moment in our financial markets,” he stated, referencing the nearly $4 trillion digital asset economy that continues to expand rapidly.

Regulating DeFi and digital commodities

When questioned by Senator John Boozman about the agency’s potential role in overseeing decentralized finance (DeFi), Selig underscored the importance of a vigilant regulatory agency. Boozman, advocating for the CFTC’s exclusive jurisdiction over spot digital commodity trading, questioned how Selig might approach DeFi’s complex features and onchain applications.

“In considering DeFi, we should examine onchain markets and applications carefully, particularly where third-party intermediaries exist,” Selig explained. “Effective regulation requires a ‘cop on the beat’ to protect investors and ensure fair markets, especially in the rapidly evolving digital asset space.”

The committee also discusses a forthcoming market structure bill intended to expand the CFTC’s oversight capabilities, reflecting bipartisan interest in strengthening regulation for crypto commodities and derivatives.

Additionally, Selig addressed concerns over crypto enforcement and market integrity, emphasizing the need for clear rules in spot digital asset markets—an issue of particular interest amid ongoing debates about the appropriate scope of regulation for the crypto industry.

Leadership concerns within the CFTC

Senator Amy Klobuchar highlighted the current leadership vacuum at the CFTC, noting that acting Chair Caroline Pham has been the sole commissioner since September. With only one commissioner, the agency lacks a full bipartisan panel, raising questions about regulatory stability and decision-making authority.

Selig acknowledged the importance of diverse perspectives and expressed willingness to work with whoever the president appoints, noting that several seats remain open until confirmed, which could impact the agency’s future direction during critical policy discussions.

https://www.cryptobreaking.com/cftc-nominee-unveils-defi-regulation/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=CFTC%20Nominee%20Unveils%20DeFi%20Regulation%20Plans%20at%20Confirmation%20Hearing%20

Comments

Post a Comment