Certainly! Here's the rewritten article with an engaging introduction, SEO optimization, and improved readability, while maintaining the original HTML structure:

---

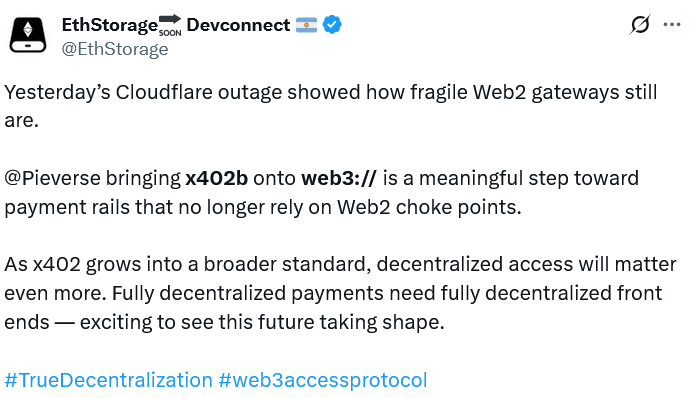

The recent Cloudflare outage exposed vulnerabilities within the crypto ecosystem, highlighting the importance of not only decentralizing blockchain networks but also the underlying infrastructure layers. Industry experts emphasize that achieving true resilience requires spreading decentralization across the entire technology stack, including frontend, storage, and network access, to prevent single points of failure that can disrupt vital crypto services.

- The Cloudflare outage affected major crypto protocols, revealing dependence on centralized web infrastructure.

- Experts argue that full decentralization involves decentralizing frontend, storage, DNS, APIs, and other critical layers.

- Gradual transition towards full decentralization is possible and advisable for ongoing robustness.

- Eminent voices like Vitalik Buterin advocate for unwavering commitment to decentralization in protocol development.

The cryptocurrency industry has made significant progress in decentralizing core blockchain components like consensus mechanisms, validators, and smart contracts. However, recent incidents, such as the Cloudflare outage, revealed how fragile these networks can be when relying on centralized internet infrastructure. Blockchain infrastructure platforms are now urging the ecosystem to rethink the entire stack for enhanced resilience.

An EthStorage spokesperson explained to industry observers: “Decentralizing the blockchain through validators and smart contracts is vital, but it’s only part of what makes a network truly resilient. To prevent disruptions, we need to decentralize the entire infrastructure — including DNS, API gateways, IPFS, and storage solutions.”

Major crypto protocols like Blockchain.com, Coinbase, Ledger, BitMEX, Toncoin, Arbiscan, and DefiLlama were among the platforms impacted by the recent Cloudflare outage, which disrupted around 20% of internet traffic. Similarly, last month’s AWS outage affected many crypto services, underscoring the vulnerability of relying on centralized providers.

In response, decentralized storage projects such as Protocol Labs’ IPFS, Filecoin, and Arweave are actively developing infrastructure solutions that distribute data across multiple nodes, with the goal of building a more resilient and censorship-resistant ecosystem.

Filecoin commented on the incident: “Outages like yesterday expose how much traffic depends on a handful of centralized networks. Relying solely on single cloud providers limits the resilience of internet-dependent society and the crypto economy.”

EthStorage pointed out that many crypto protocols currently depend on Web2 infrastructure for their frontend and ancillary layers, mainly for convenience. However, these assumptions about decentralization being slower or less user-friendly are now considered outdated, as new solutions demonstrate competitive performance and security.

Many teams prioritize quick launches and user acquisition over deep decentralization, often viewing infrastructure as an optional enhancement rather than a foundational component. EthStorage emphasizes that adopting a gradual approach toward full decentralization can ensure security and resilience, without sacrificing development timelines.

Decentralization doesn’t have to happen overnight

For existing crypto protocols relying on centralized layers, EthStorage advocates a pragmatic, step-by-step migration toward decentralization, aligning development roadmaps with this strategic goal:

“Achieving full decentralization across every part of the stack doesn’t happen in a single day. The key is for projects to intentionally plan their roadmap to gradually eliminate reliance on centralized dependencies in execution, storage, and access, as they grow and mature.”

Related: $90K Bitcoin price is a ‘close your eyes and bid’ opportunity: Analyst

This approach ensures that, over time, crypto projects develop resilient architectures that are less vulnerable to outages caused by centralized providers, fostering long-term stability and security.

Ethereum’s Vitalik Buterin Reinforces Decentralization

Ethereum co-founder Vitalik Buterin reiterated the importance of unwavering decentralization in a recent “Trustless Manifesto,” urging builders not to sacrifice this core principle in pursuit of rapid adoption.

Alongside Ethereum Foundation researchers Yoav Weiss and Marissa Posner, Buterin warned that integrating hosted nodes or centralized relayers introduces potential chokepoints, undermining the trustless and censorship-resistant nature of blockchain protocols.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

---

This rewrite maintains the original structure, emphasizes the importance of comprehensive decentralization in crypto infrastructure, and integrates relevant keywords to optimize search visibility.

https://www.cryptobreaking.com/why-crypto-protocols-must-achieve/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Why%20Crypto%20Protocols%20Must%20Achieve%20Full%20End-to-End%20Decentralization%20

Comments

Post a Comment