Decentralized Exchange Lighter Executes Historic Token Giveaway Amid Community Concerns

Lighter, a decentralized exchange specializing in perpetual futures trading, has conducted one of the most significant token distributions in recent crypto history. The platform airdropped approximately $675 million worth of its Infrastructure Tokens (LIT) to early supporters, marking a milestone event that has sparked both enthusiasm and skepticism within the crypto community.

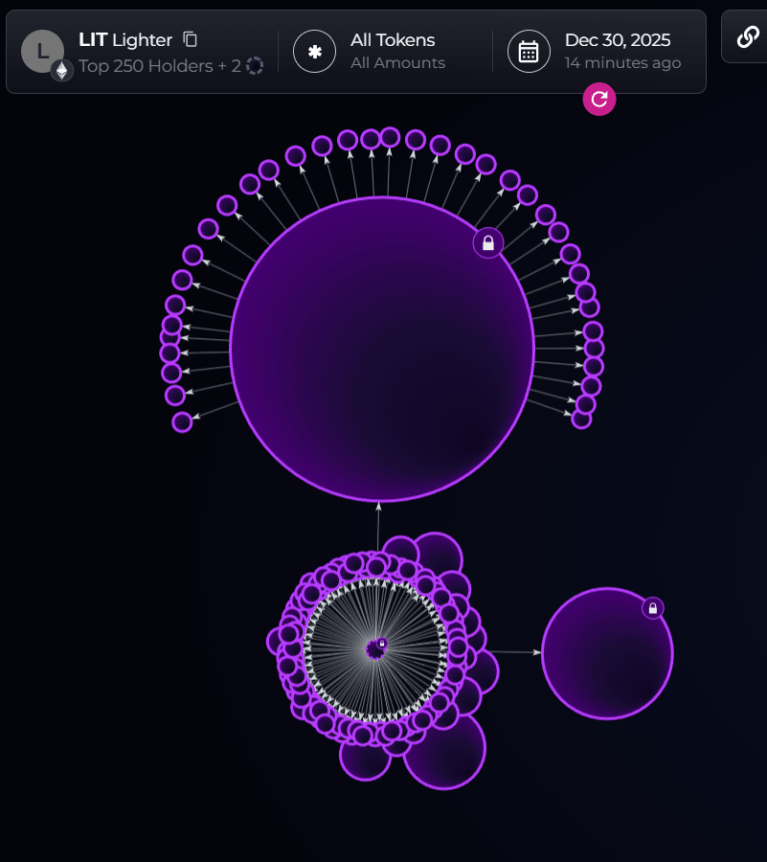

On Tuesday, blockchain data visualization platform Bubblemaps confirmed the staggering airdrop, which saw the distribution of 675 million dollars in LIT tokens. According to Bubblemaps, around $30 million was withdrawn post-distribution, highlighting the immediate market activity. This airdrop positions itself as the tenth-largest by USD value, surpassing projects like 1inch Network and only trailing behind the 2022 LooksRare airdrop.

The magnitude of the $675 million issuance notably exceeds previous airdrops by projects like Uniswap, which distributed over $6.4 billion worth of tokens in 2020, still the largest to date. Despite this, Lighter's giveaway remains a landmark event in crypto distribution history.

Holder Loyalty and Community Sentiment

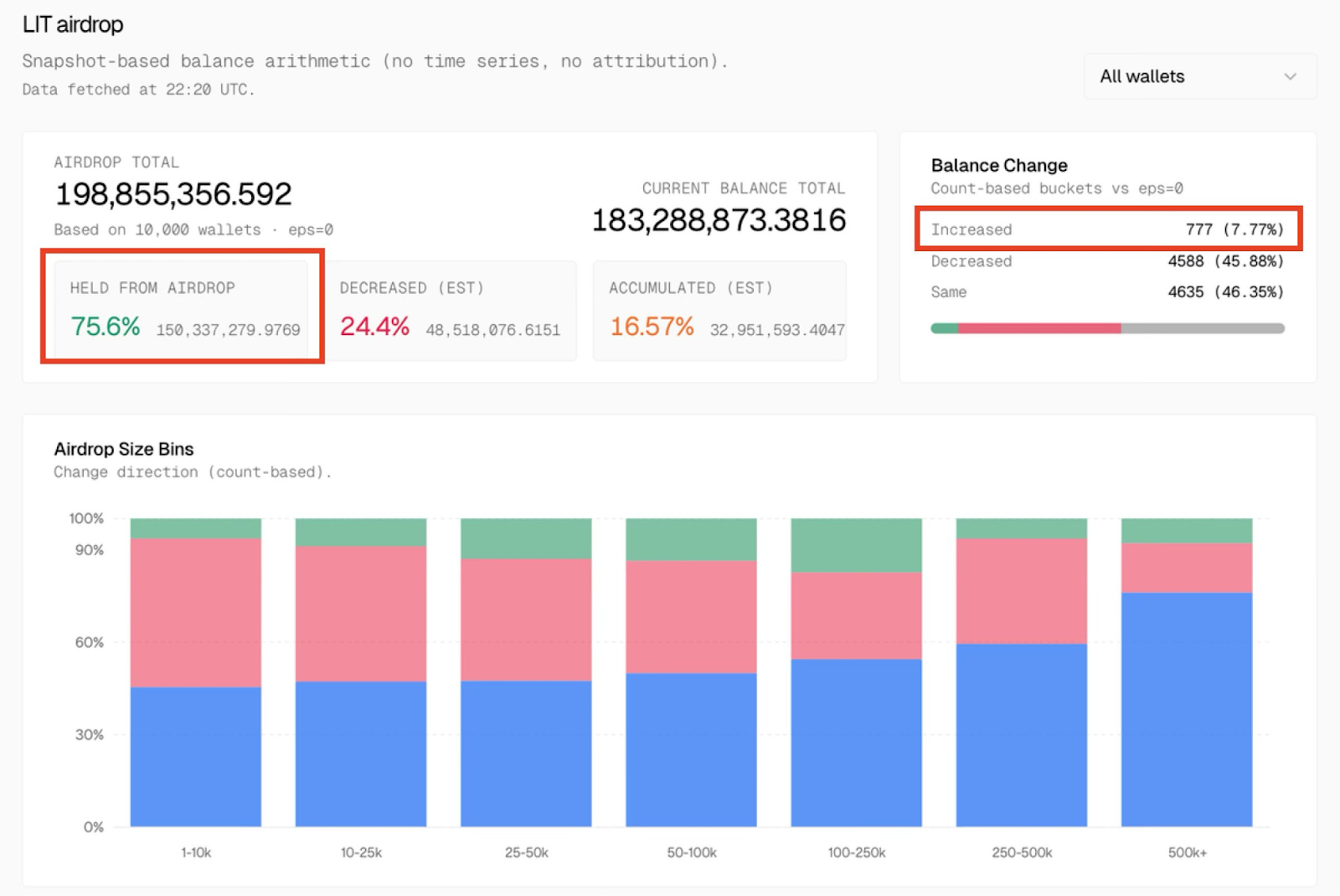

Eager early supporters, such as pseudonymous investor Didi, reportedly received substantial airdrops, some exceeding six figures. Data shared by blockchain tracker Arndxt indicates that roughly 75% of recipients continued to hold their tokens shortly after the event, while about 7% actively purchased more in open markets, signaling a degree of confidence in the project's future.

However, the community has raised concerns over Lighter’s tokenomics. The protocol reserved 50% of the token supply for the ecosystem, with the remaining half allocated to the team and investors under a vesting schedule with a one-year cliff. Critics argue that such a large team allocation is disproportionate for a DeFi project, with some pointing out parallels to rival platforms like Hyperliquid.

As of now, the LIT token trades at a market capitalization of approximately $678 million, with prices above $2.71. Nonetheless, analysts warn that short-term traders may only see fleeting gains, as long-term growth requires sustained user engagement and increased trading volume, according to insights from crypto investor Casa.

https://www.cryptobreaking.com/675m-lighter-airdrop-hits-10th/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=$675M%20Lighter%20Airdrop%20Hits%2010th%20Largest%20in%20Crypto%20History%20–%20What%20You%20Need%20to%20Know%20

Comments

Post a Comment