AI-driven Forecasts Signal a Maturing Crypto Market in 2026

Artificial intelligence has evolved from a mere research tool into a dominant force shaping market predictions across global asset classes, including cryptocurrencies. In 2025, the adoption of large language models has surged among funds and analysts, enabling deeper analysis of macro signals, on-chain data, and regulatory developments. As the crypto landscape prepares for 2026, AI forecasts suggest a market increasingly influenced by institutional capital, infrastructure improvements, and evolving regulation.

Key Takeaways

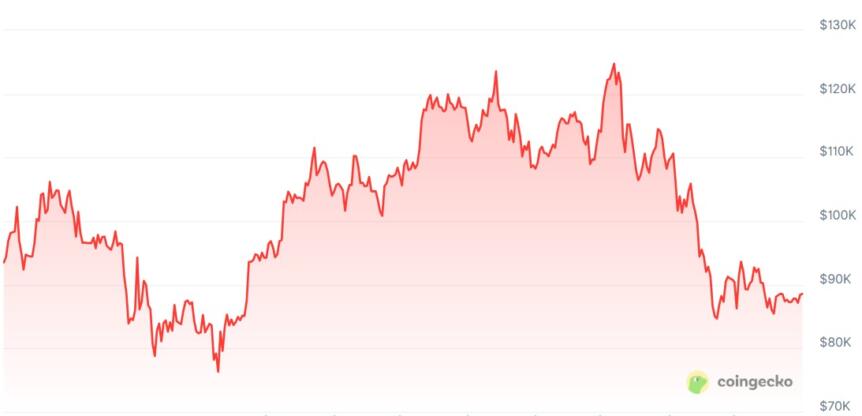

- AI models project Bitcoin prices between $85,000 and $250,000 by 2026, driven by institutional inflows and macroeconomic tailwinds.

- Ethereum's value could range from $3,000 to $18,000, buoyed by ecosystem maturation and scaling upgrades.

- Major altcoins such as BNB, XRP, and Solana are forecasted to experience significant growth, contingent on regulatory clarity and developer activity.

- Risks include regulatory headwinds, macroeconomic tightening, and technical vulnerabilities, which could temper market gains.

Tickers mentioned: $BTC, $ETH, $BNB, $XRP, $SOL, $TRX, $DOGE, $ADA

Sentiment: Neutral to cautiously optimistic regarding broader institutional involvement and technological progress.

Price impact: Positive, as institutional adoption, technological upgrades, and macroeconomic factors align to support bullish forecasts.

Market Context

The predictions align with wider industry trends pointing towards increased regulation, institutional participation, and infrastructure growth, suggesting a maturing and more stable crypto market in 2026.

AI-Powered Price Predictions for 2026

Bitcoin

ChatGPT: $85,000–$180,000

Gemini: $100,000–$220,000

Grok: $100,000–$250,000

Copilot: $85,000–$135,000

Bullish catalysts:

- Consistent institutional inflows, particularly via spot ETFs, corporate treasuries, and broad-based adoption, reinforce Bitcoin’s role as a macro asset.

- Accommodative macroeconomic environment, post-halving supply constraints, and sovereign accumulation may bolster the "digital gold" narrative.

Bearish risks:

- Reversal in global monetary conditions, inflation persistence, or economic shocks could reduce liquidity and dampen demand.

- Regulatory tightening around custody and ETF structures might impede institutional engagement.

Ethereum

ChatGPT: $3,000–$9,000

Gemini: $7,000–$18,000

Grok: $4,000–$12,000

Copilot: $8,200–$10,200

Bullish catalysts:

- Advancements in layer-2 scaling solutions, such as rollups and improvements post-Dencun, are expected to enhance throughput and fee efficiency.

- Expansion as a settlement layer for tokenized assets, stablecoins, and institutional DeFi could drive ongoing demand.

Bearish risks:

- Fragmentation across multiple layer-2 networks may weaken liquidity and value capture.

- Regulatory ambiguity around staking and DeFi activities could hinder institutional participation.

Other Notable Predictions

Altcoins like Binance Coin, XRP, Solana, Tron, Dogecoin, and Cardano show potential for substantial growth, but face risks such as regulatory hurdles, technological vulnerabilities, and declining developer activity. Notably, the forecasts suggest that ongoing infrastructure enhancements, regulatory clarity, and adoption in real-world applications will be pivotal to their success.

https://www.cryptobreaking.com/ai-models-forecast-bitcoin-ethereum/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=AI%20Models%20Forecast%20Bitcoin,%20Ethereum,%20and%20Altcoin%20Prices%20for%202026%20

Comments

Post a Comment