AlphaTON Capital Looks to Raise Over $420 Million After Exiting SEC Limitations

AlphaTON Capital, a small-cap publicly traded firm focused on artificial intelligence and the Telegram ecosystem, has signaled ambitious plans to significantly increase its fundraising capacity. The company recently filed a shelf registration statement worth over $420 million, aiming to access larger pools of capital to support its growth initiatives in the rapidly evolving AI and blockchain sectors.

By surpassing the Securities and Exchange Commission’s (SEC) “baby-shelf” limitations, AlphaTON Capital can now pursue broader offerings, a move that positions it for potentially substantial capital influxes. The “baby-shelf” rules restrict small companies from raising large sums through shelf registrations to prevent market dilution, but AlphaTON’s filing indicates its desire to expand beyond these constraints. Nonetheless, raising such a substantial amount will depend on sustained investor demand and institutional interest.

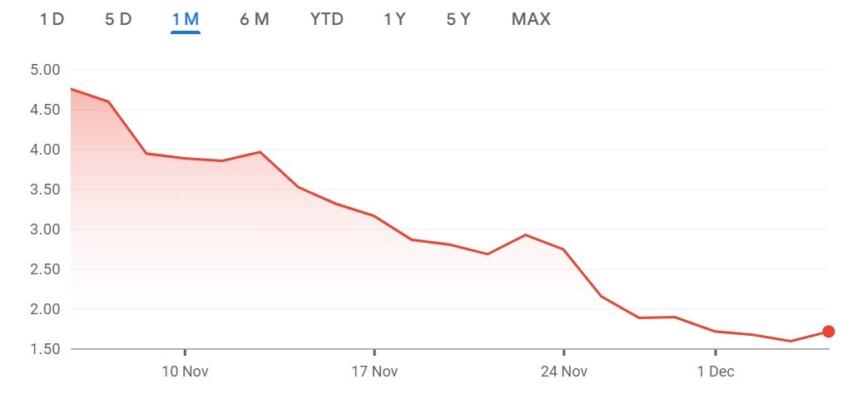

Currently, AlphaTON stock, traded under the ticker ATON, has experienced significant volatility. According to Google Finance data, the share price plummeted from $4.75 on November 5 to approximately $1.71 at present—a decline of roughly 64% in one month. Despite this, the company's market capitalization stands at approximately $13 million, with an average trading volume of $1.55 million. Notably, the company holds over 12.8 million Toncoin tokens, valued at about $20.5 million, according to CoinGecko.

Strategic Expansion in AI and Telegram Ecosystem

AlphaTON’s recent filing highlights its goal of raising funds to enhance its AI infrastructure within the Telegram ecosystem. The company plans to accelerate the development of GPU infrastructure for Telegram’s Cocoon AI network and acquire revenue-generating Telegram applications. Additionally, it intends to increase its holdings of Toncoin tokens, bolstering its treasury amidst its expansion efforts.

While the company’s announcement sparked a short-lived rally—raising the stock price from a low of $1.49 to $1.71, a 14.7% increase—successful capital raise hinges on market conditions and investor appetite. If it manages to secure the planned funds, AlphaTON could significantly advance its integrated AI initiatives aligned with the Ton blockchain.

Analysts observe that the company’s move occurs at a time when the digital asset treasury sector, particularly corporate crypto holdings, is experiencing a slowdown. November saw a dip in inflows, with Bitcoin treasury allocations dominating, but Ethereum-based treasuries facing outflows, signaling a cautious investor environment amid broader market fluctuations.

https://www.cryptobreaking.com/alphaton-files-420-69m-registration/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Alphaton%20Files%20$420.69M%20Registration%20as%20Tiny%20Ton%20Treasury%20Targets%20AI%20Expansion%20

Comments

Post a Comment