Bitcoin Shows Signs of Structural Weakness as Risks Mount Near $90,000

Despite maintaining levels above $90,000, recent data indicates that Bitcoin remains vulnerable to a significant correction. Analysts are flagging mounting systemic risks, with macroeconomic factors and on-chain market signals suggesting that the current bullish momentum may be fragile and susceptible to further declines.

Key Takeaways

- Bitcoin’s risk-off indicator signals high vulnerability, previously associated with bearish phases.

- The profit-loss sentiment has plunged to an extreme -3, implying deep on-chain corrections.

- A 32% drawdown places Bitcoin between correction and capitulation zones, increasing the likelihood of a prolonged decline.

- Despite recent price stabilization, macroeconomic and on-chain factors point to persistent downside risks.

Market Risk Indicators Signal Growing Concern

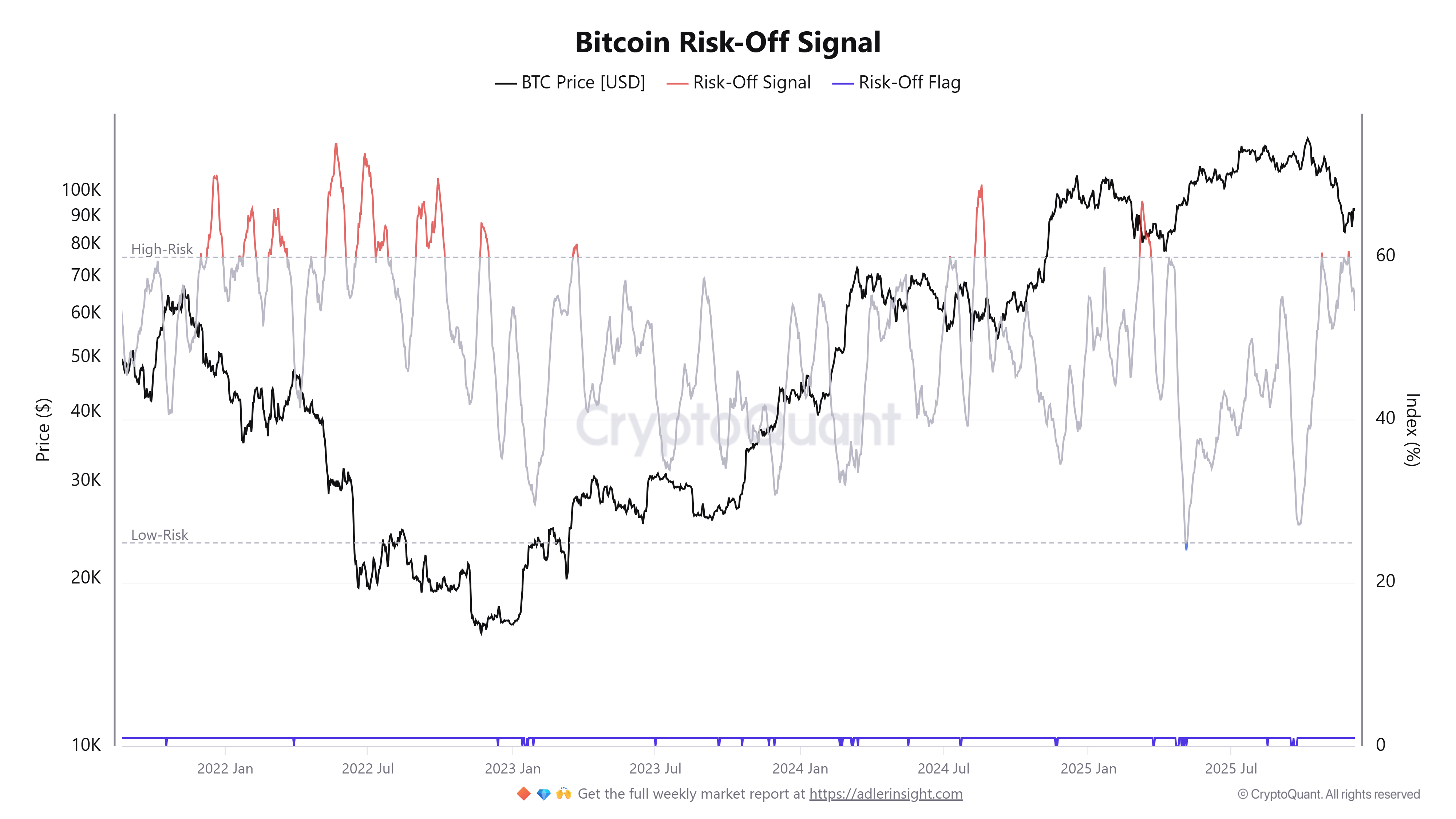

CryptoQuant’s risk-off model, which scrutinizes six market metrics—including volatility measures, exchange inflows, funding rates, futures activity, and market capitalization—remains near 60, classifying the market within the “High-Risk” zone. Historically, such levels have been precursors to market downturns, suggesting that Bitcoin’s current rally may be approaching a critical juncture.

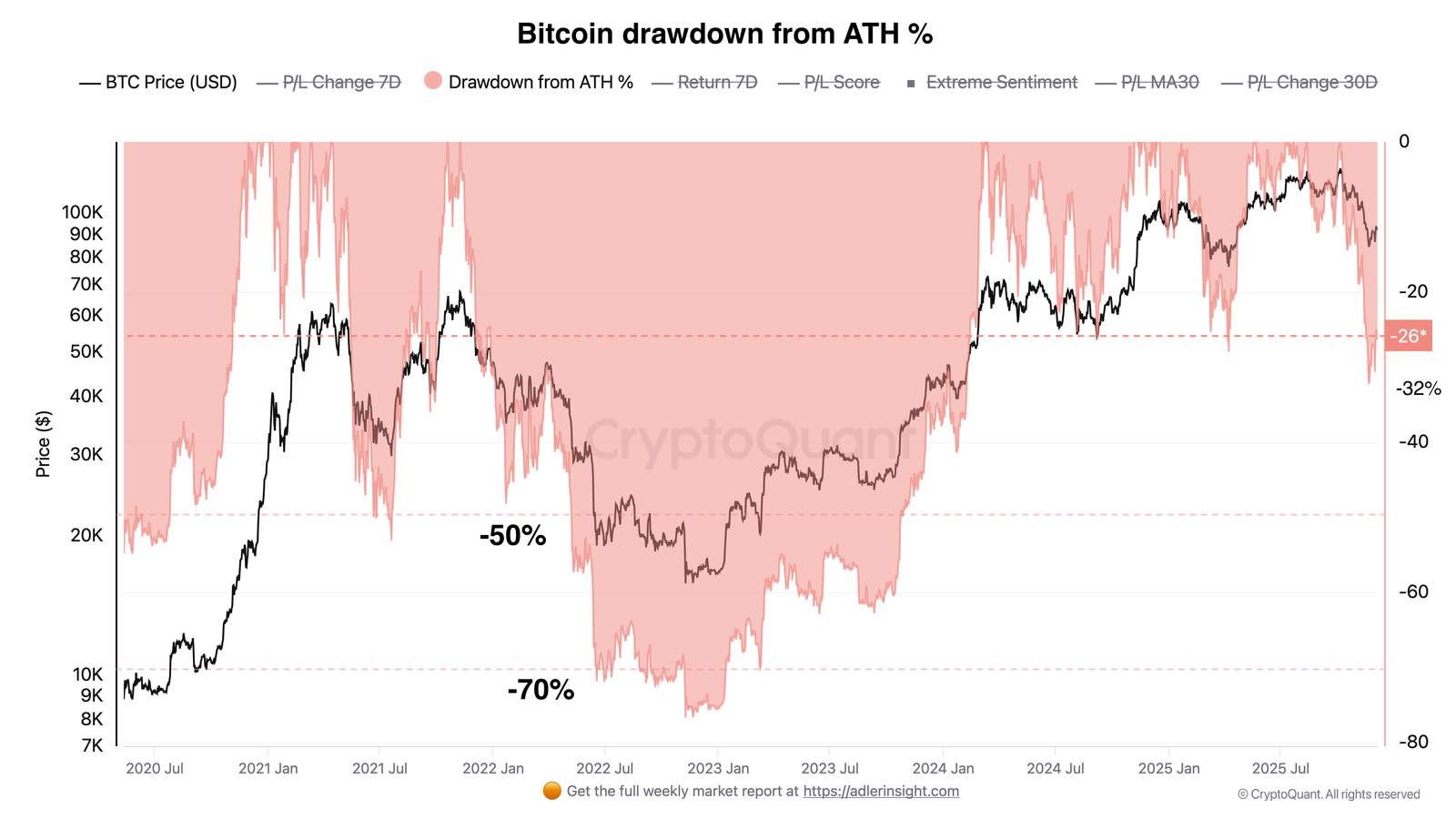

Further analysis by Bitcoin researcher Axel Adler Jr highlights that the profit/loss score has hit -3, reflecting a high concentration of unprofitable UTXOs—correlating historically with bearish markets and extended cooling phases. The current drawdown exceeds typical correction levels (20-25%) but remains above capitulation thresholds (-50% to -70%), situating Bitcoin in an unstable “intermediate zone.”

Adler emphasizes that, without improvements in macroeconomic conditions and on-chain profitability, downside risks remain elevated, even as the price hovers near $90,000.

On-chain data from Glassnode offers a slightly optimistic note, revealing that the recent drawdown triggered the largest spike in realized losses since the FTX collapse of 2022. Short-term holders (STHs) accounted for most of these losses, while long-term holders (LTHs) exhibited resilience, suggesting some underlying strength in foundational investor positions.

Overall, market analysts warn of continued volatility and potential downside, especially if Bitcoin struggles to break through critical resistance levels.

$100,000 Bitcoin: A Psychological and Technical Crossroads

Expansion towards the $100,000 mark is viewed by some analysts as a psychological turning point. While a breakout could revitalize momentum—possibly aided by an expected Federal Reserve rate cut on December 10—major round numbers frequently evoke volatility and failed attempts at breakouts.

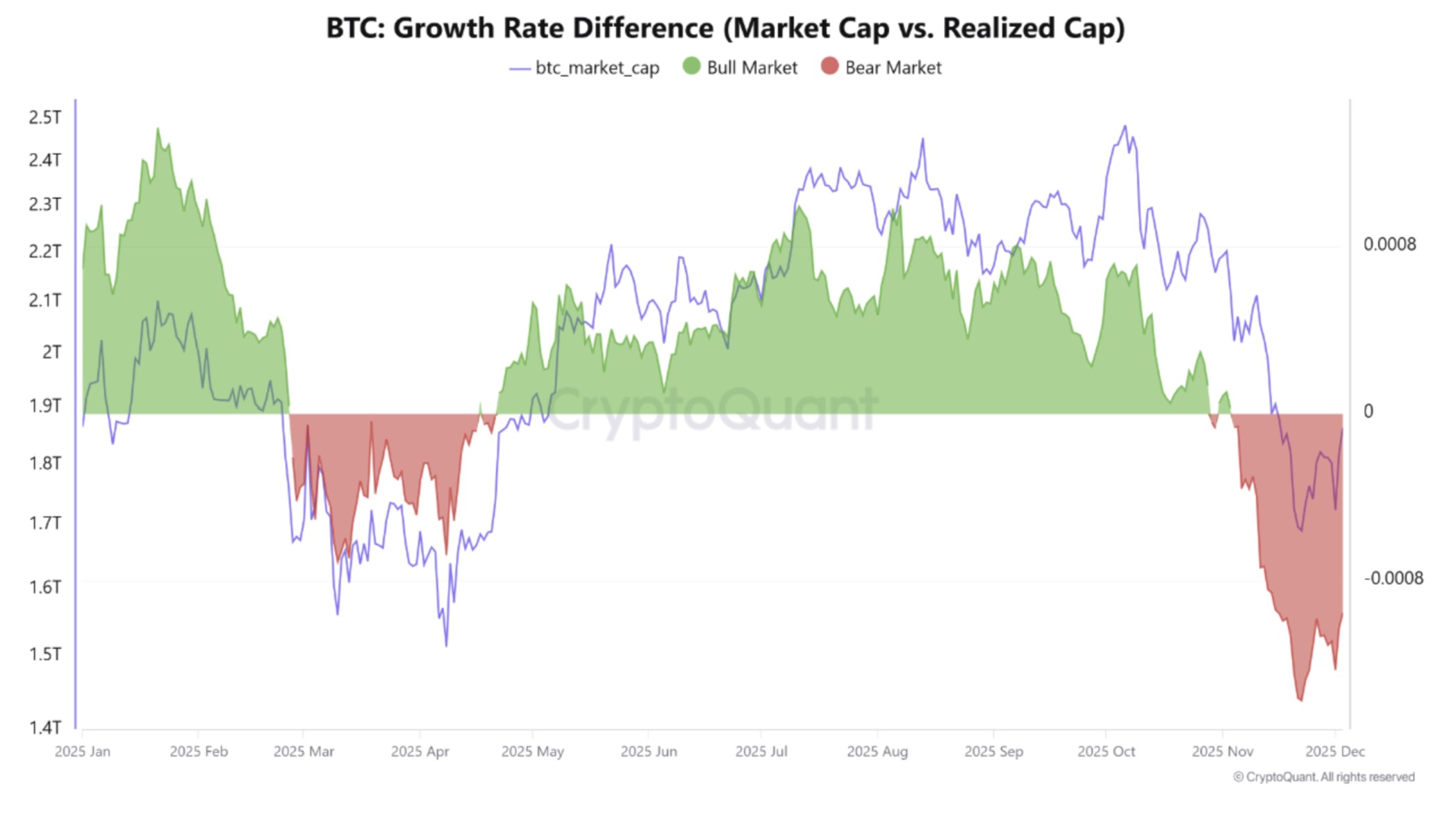

Current data indicates that Bitcoin’s market capitalization is shrinking faster than realized cap, measuring at -0.00095. This suggests that structural weakness persists, with price action potentially consolidating within the $82,000 to $92,000 range, pending a decisive breach of resistance levels.

Meanwhile, trader insights highlight that if Bitcoin fails to surpass key resistance, it could remain trapped in this range for an extended period, reflecting ongoing uncertainty and the delicate balance between momentum and correction.

https://www.cryptobreaking.com/bitcoin-risk-off-signal-persists/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Bitcoin%20Risk-Off%20Signal%20Persists%20Above%20$100K—What%20It%20Means%20for%20Investors%20

Comments

Post a Comment