US Investor Sentiment Shifts Away from Crypto Amid Rising Caution

Recent findings from the Financial Industry Regulatory Authority (FINRA) reveal a notable decline in risk appetite among American investors concerning cryptocurrency investments. Despite steady overall participation, fewer investors are considering increasing their holdings or entering the market for the first time, reflecting broader macroeconomic uncertainties and shifting investor priorities.

Key Takeaways

- Investor willingness to take risks, especially among younger demographics, has decreased significantly since 2021.

- Majority of US investors now view cryptocurrencies as a risky asset, up from previous years.

- The pace of new entrants into crypto markets has slowed considerably over the past two years.

- Despite risk aversion, many investors still recognize crypto’s role in achieving financial goals, often accepting higher risks.

Tickers mentioned: None.

Sentiment: Bearish

Price impact: Negative. Increasing caution and declining new investments suggest subdued demand and potential downward pressure on crypto prices.

Trading idea (Not Financial Advice): Hold. Given the reduced risk appetite, maintaining existing positions and avoiding aggressive expansion may be prudent.

Market context: Broader macroeconomic uncertainties are dampening enthusiasm for crypto, often seen during periods of economic instability.

Investor Caution Reflects Broader Market Trends

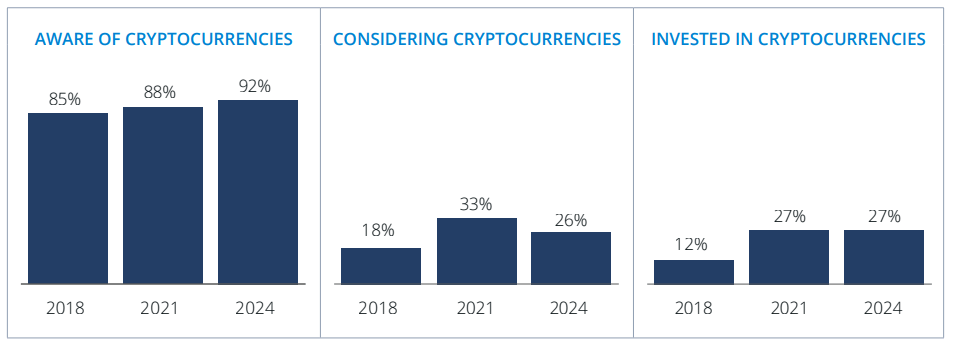

Data from the comprehensive study, conducted between July and December 2024 with over 2,800 US investors and a nationwide online survey, underlines a growing cautious outlook. While 27% of investors held cryptocurrency in 2024—unchanged from 2021—the percentage considering either buying more or starting anew dropped from 33% to 26%. Notably, those with high-risk tolerance fell from 12% to 8%, with the sharpest decline among investors under 35, dropping nine percentage points to 15%.

The survey also highlights a heightened perception of risk, with 66% of respondents labeling crypto as a risky investment—up from 58% three years prior. Interestingly, a third of investors believe high risk is necessary to meet financial goals, rising to 50% among those under 35. Additionally, approximately 13% of investors, including nearly one-third of individuals under 25, have engaged in viral investment strategies such as purchasing meme stocks.

Slowing Entry into Markets

The rate at which new investors are joining crypto markets has significantly declined, with only 8% entering within the last two years, compared to 21% in 2021. This retrenchment aligns with the end of the pandemic-driven surge in younger investor participation, pushing the demographic back to pre-pandemic levels. Overall, the findings suggest a shift toward a more cautious investment climate, where risk considerations outweigh enthusiasm.

https://www.cryptobreaking.com/crypto-interest-falls-as-investor/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Crypto%20Interest%20Falls%20as%20Investor%20Risk-Taking%20Weakens%20

Comments

Post a Comment