Poland Sees Setback in Crypto Regulation as President Veto Holds

The Polish lower house failed to muster the necessary three-fifths majority to override President Karol Nawrocki’s veto against the Crypto-Asset Market Act. This legislative development hampers efforts to formalize the country’s digital-asset framework despite growing calls from lawmakers for urgent regulatory action amid expanding crypto activity.

Key Takeaways

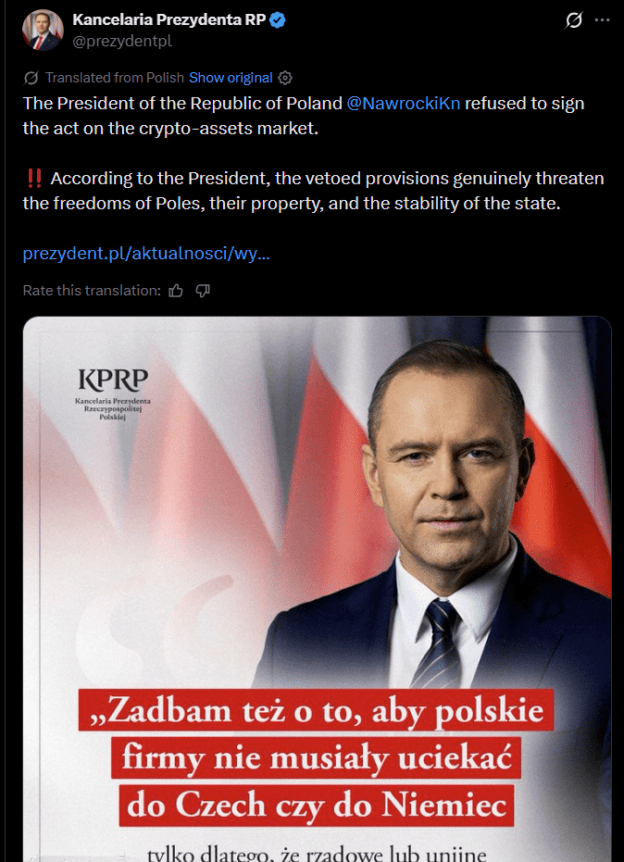

- Poland's crypto law, aligned with EU’s MiCA framework, was rejected after President Nawrocki vetoed it citing concerns over freedoms, property rights, and national stability.

- The bill was introduced by Prime Minister Donald Tusk's government in June and aimed to establish comprehensive regulation for crypto markets.

- Supporters viewed the legislation as crucial for national security, particularly to prevent misuse by foreign actors; opponents warned it would impose excessive burdens on startups and stifle innovation.

- Despite regulatory delays, crypto adoption continues to surge in Poland, with increases in transaction volume and Bitcoin ATM installations, reflecting growing mainstream engagement.

Tickers mentioned: None

Sentiment: Neutral

Price impact: Neutral. Regulatory uncertainty persists, but crypto activity remains robust in Poland.

Market context: The stalled legislative process highlights the broader tension between regulatory efforts and rapid adoption within European crypto markets.

Legislative Deadlock in Poland

Poland’s lower house of parliament has fallen short of the three-fifths majority required to override President Nawrocki’s veto of the Crypto-Asset Market Act. The legislation was designed to align Polish crypto regulation with the European Union’s Markets in Crypto-Assets (MiCA) framework, introduced to establish clearer rules across member states. However, last week, Nawrocki blocked the bill, citing concerns that the legislation could threaten citizens' freedoms, property rights, and challenge the nation’s stability, as previously reported by Cointelegraph.

The veto means the bill will not advance, compelling the government to initiate a new legislative process. The divide among lawmakers and industry stakeholders stems from differing views on balancing security and innovation. Advocates argue that comprehensive regulation is essential to combat fraud and protect the country from potential misuse by foreign powers, including Russia. Conversely, critics—particularly within the crypto industry—warn that the proposed rules are overly restrictive, including stringent licensing requirements, high compliance costs, and criminal liability provisions for executives, which could hinder startups and reduce Poland’s competitiveness in the digital economy.

The legislative setback has not halted crypto activity in Poland. According to Chainalysis’ 2025 Europe Crypto Adoption report, the country experienced over 50% year-over-year growth in overall transaction volume, making it one of Europe’s largest crypto economies. Poland ranked eighth in the continent for total cryptocurrency received between July 2024 and June 2025, underscoring the sector’s rapid expansion.

Investors in Poland are increasingly turning to Bitcoin, with a significant rise in ATM installations. In January, reports indicated that Poland had become the fifth-largest Bitcoin ATM hub globally, surpassing El Salvador—a country that adopted Bitcoin as a core part of its monetary system. Despite regulatory delays, the country’s crypto landscape continues to evolve quickly, reflecting a strong appetite for digital assets amid ongoing legislative debates.

https://www.cryptobreaking.com/poland-cant-override-crypto-bill/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Poland%20Can't%20Override%20Crypto%20Bill%20Veto,%20Postponing%20Cryptocurrency%20Regulations%20

Comments

Post a Comment