Historic Activation of Bitcoin-Backed Casascius Coins Unlocks Over $179 Million

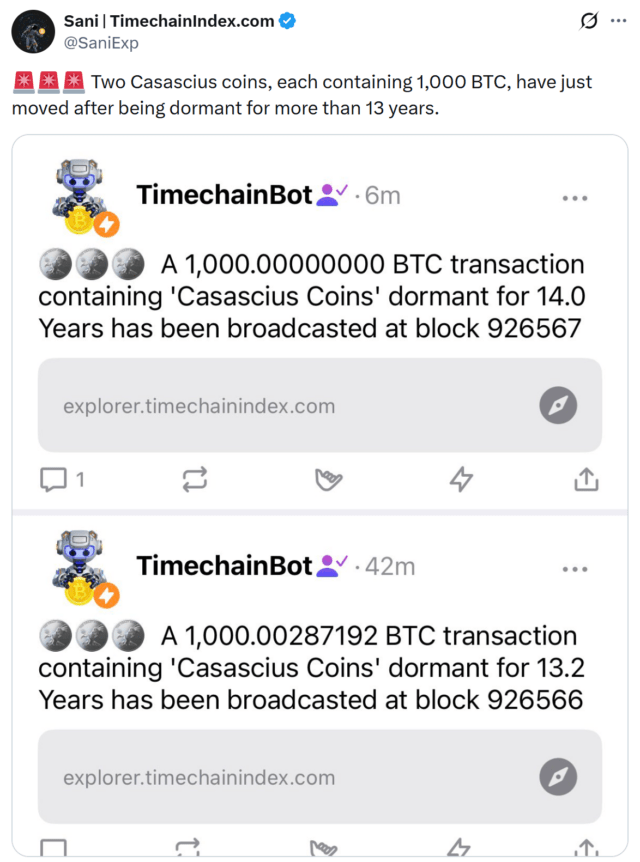

Two vintage Casascius physical coins, each embedded with 1,000 Bitcoin, have recently been activated after more than 13 years, revealing a combined value exceeding $179 million. The discovery underscores the enduring allure of physical Bitcoin collectibles and highlights the remarkable growth of the cryptocurrency market since these coins were initially minted.

Onchain analysis shows that one of these Casascius coins was minted in October 2012 when Bitcoin's price was approximately $11.69. The other was produced earlier in December 2011, at a mere $3.88 per Bitcoin. This means that the latter coin has an unrealized theoretical gain of around 2.3 million percent, not accounting for minting costs, illustrating the extraordinary appreciation of Bitcoin over the past decade.

A Brief History of Casascius Coins

Created by Utah-based entrepreneur Mike Caldwell, Casascius coins are physical metal tokens designed as collectible representations of Bitcoin. Manufactured between 2011 and 2013, these coins encapsulate Bitcoin within a tangible form, making them highly sought-after by enthusiasts and collectors alike.

Each Casascius coin contains a hidden digital Bitcoin value embedded within a tamper-resistant hologram, accompanied by a paper piece with its corresponding private key. Denominations ranged from 1 to 1,000 Bitcoin, with only a limited number of each minted—16 of the 1,000 BTC bars and six of the 1,000 BTC coins are believed to exist today. The activation of the recent coins marks a significant milestone, allowing owners to redeem the private key and realize the coins' full Bitcoin value.

Operational Mechanics and Market Implications

To redeem a Casascius coin, the owner must lift the holographic sticker to access the private key, which then grants access to the embedded Bitcoin. Once redeemed, the coin loses its digital Bitcoin value, serving purely as a collectible. Importantly, this process does not imply an imminent flood of Bitcoin onto the market. For instance, in July, a owner known as "John Galt" moved his 100 Bitcoin stash from the physical coin to a hardware wallet for better security, with no plans to cash out immediately. He emphasized that holding such a large amount was more about safety than wealth realization.

While physical Bitcoin coins like Casascius have faded from commercial production, their historical significance remains. Events like this recent activation serve as potent reminders of Bitcoin's decentralized evolution and enduring appeal among collectors and long-term investors alike.

https://www.cryptobreaking.com/two-hidden-casascius-coins-reveal/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Two%20Hidden%20Casascius%20Coins%20Reveal%20$179M%20in%20Bitcoin%20Gains%20

Comments

Post a Comment