Ethereum Validator Exit Queue Nears Zero, Signaling Reduced Selling Pressure

The Ethereum network is experiencing a significant shift in validator participation, with the exit queue falling back toward zero for the first time since July of last year. Analysts suggest this development could ease selling pressure and reflect a growing confidence among validators to remain committed to the network.

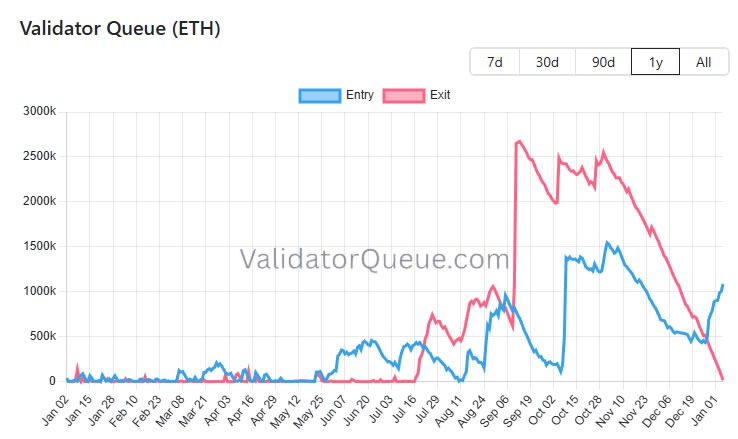

Data from Beaconcha.in indicates that the current exit queue contains just 32 Ether, with an average wait time of around one minute. This sharply contrasts with its peak of 2.67 million ETH in mid-September, representing a 99.9% reduction. Simultaneously, the entry queue has surged to 1.3 million ETH — its highest point since mid-November — highlighting an increased interest in staking Ether.

Asymetrix's CTO Rostyk described the situation, stating, “The validator exit queue is essentially empty. No one wants to sell their staked ETH right now.”

Further, Tevis, founder of the AlphaLedger trading platform, pointed out that “ETH exchange reserves are at their lowest levels in ten years. Selling pressure is diminishing, and the influx of new validators staking ETH for yield, especially driven by entities like BitMine and ETF players, is outpacing exits.”

In the context of network dynamics, unstaking Ether often signals validators' intentions to liquidate holdings, pursue different yield opportunities, or rebalance portfolios. Conversely, staking ETH is viewed as a strong sign of confidence in Ethereum's future, reflecting long-term commitment.

No Backlog of Validators Waiting to Exit

The validator exit queue primarily governs how quickly validators can fully withdraw from network consensus. This queue acts as a safeguard against mass exits that could destabilize the network, ensuring that validators remain active by earning rewards while risking penalties during the waiting period.

Unlike the withdrawal queue, which handles partial withdrawals of accumulated rewards, the exit queue pertains to full validator departures. The current near-zero exit queue suggests minimal unstaking pressure, enabling prompt processing of new exit requests if needed.

In December, experts predicted that the exit queue could approach zero, and recent data confirms that trend. A zero queue status indicates fewer validators seeking to exit en masse, strengthening network stability and confidence.

BitMine Accelerates ETH Staking

Leading the charge, BitMine, the world's largest Ether treasury, has ramped up its staking activities in recent weeks. Since initiating staking on December 26, the company added an additional 82,560 ETH to the entry queue on January 3, bringing its total staked ETH to approximately 659,219 — valued at about $2.1 billion at current prices.

BitMine now holds over 4.1 million ETH, accounting for roughly 3.4% of the total supply and valued at approximately $13 billion. The firm's aggressive staking strategy underscores institutional confidence in Ethereum’s staking ecosystem, amid a broader trend of validators choosing to remain committed.

https://www.cryptobreaking.com/ethereum-validator-exit-queue-hits/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Ethereum%20Validator%20Exit%20Queue%20Hits%20Zero%20as%20ETH%20Price%20Soars%20

Comments

Post a Comment