Vivek Ramaswamy-backed Strive disclosed a rapid post-merger milestone: it has retired about 92% of the debt it inherited from Semler Scientific and expanded its Bitcoin position after closing a preferred stock offering earlier this month. The company said it has added another 334 BTC to its balance sheet and is directing proceeds from the sale of Variable Rate Series A Perpetual Preferred Stock (SATA) toward debt reduction, Bitcoin accumulation, and related assets. The finance round attracted substantial demand, enabling Strive to lift its target raise from $150 million to $225 million, underscoring continued interest in corporate Bitcoin strategies even as markets oscillate.

The broader context is that Strive’s move follows a pattern seen among corporate treasuries seeking to harvest yields on crypto exposure without taking on more leverage. By pairing the debt paydown with tactical crypto buys, the company aims to strengthen its balance sheet while expanding its Bitcoin exposure—an approach that has become increasingly common in the years since large holders began converting cash reserves into digital assets.

Strive’s acquisition of Semler Scientific was finalized on Jan. 13 after the two parties agreed to merge the previous September. The combination created a vehicle for Strive to pursue a Bitcoin-centric treasury strategy with a more robust capital-raising mechanism. The company had signaled earlier this month that it would use the capital raised, along with available cash and potential proceeds from unwinding hedges, to retire liabilities and fund further Bitcoin-related purchases. In a notable move, Strive confirmed that it would deploy the proceeds to retire $110 million of Semler debt (92% of the inherited balance), including $90 million of convertible notes exchanged for SATA stock and the full repayment of a $20 million Coinbase credit loan. This repayment effectively unshackles its Bitcoin holdings from encumbrances and sets the stage for more rapid balance-sheet optimization.

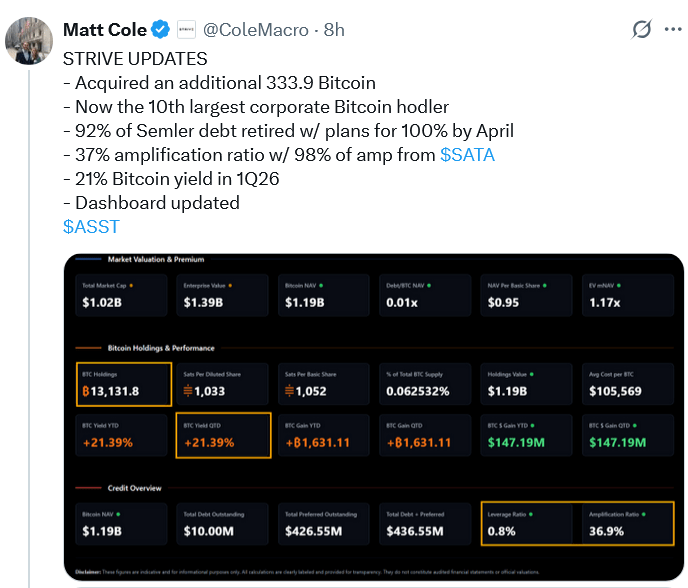

With the Coinbase loan retired, Strive said its Bitcoin holdings are now fully unencumbered. The company plans to settle the remaining $10 million debt within about four months, a move that should further improve liquidity and flexibility for future purchases. Since the transaction, Strive has added 333.9 BTC at an average price of roughly $89,851, lifting its total holdings to 13,132 BTC with an approximate market value near $1.17 billion at current prices. The company also disclosed a quarterly Bitcoin yield of 21.2%, illustrating the pace at which its exposure is growing relative to its per-share metrics.

Following these steps, Strive has vaulted into a position among the top 10 corporate Bitcoin treasuries by holdings—a notable milestone for a company that has built its narrative around Bitcoin as a strategic asset rather than a mere hedge. The recent purchase and the debt-reduction agenda come as part of a broader push by corporates to deploy crypto in their treasury management, balancing risk with the potential for enhanced returns during a period of volatile macro conditions.

This development sits within a wider pattern of institutional adoption, where more than 190 publicly traded companies reportedly hold Bitcoin on their balance sheets, collectively owning about 1.134 million BTC—roughly 5.4% of the cryptocurrency’s total supply. The concentration of holdings is disproportionately skewed toward a few established players, with Michael Saylor’s managing affiliates maintaining a substantial share of corporate BTC. The broader market context remains one of cautious optimism: while crypto markets have shown resilience at times, corporate strategies, hedging activity, and regulatory developments continue to shape price and risk sentiment.

The ongoing evolution of Strive’s treasury approach reflects a broader trend toward using structured equity financing to support Bitcoin accumulation without increasing leverage. The SATA offering—driven by strong demand that pushed the target higher—illustrates investors’ willingness to back long-duration instruments tied to crypto exposure, provided the funds are deployed toward reducing debt and expanding holdings. The question for investors remains how enduring these strategies will prove, given the dual pressures of balance-sheet discipline and the intrinsic volatility of Bitcoin’s price.

As corporate treasuries navigate 2026, Strive’s experience could offer a blueprint for other firms weighing debt reduction alongside crypto accumulation. The company’s ability to retire a large portion of inherited obligations while keeping liquidity intact may influence how management teams structure future treasury operations, particularly in sectors with significant exposure to digital assets. However, execution risk remains clear: even with unencumbered BTC, balance-sheet management, hedging strategies, and regulatory scrutiny can introduce volatility that tests the long-term viability of such programs.

Why it matters

For investors, Strive’s actions underscore a continuing appetite for crypto-backed cash-flow strategies that do not rely on additional leverage. The combination of debt retirement and an expanded Bitcoin position signals confidence in the resilience of corporate BTC holdings as a component of strategic balance sheets, rather than a speculative bet. The rapid deleveraging tied to convertible notes and a sizable loan repayment demonstrates that even in a bear market, companies are willing to invest in durable capital structures that support crypto exposure.

From a market perspective, the move highlights how capital markets are pricing crypto treasuries as legitimate financial tools. The strong demand for SATA, which enabled the upsizing to $225 million, suggests that investors view long-duration equity linked to Bitcoin as a credible instrument when aligned with prudent balance-sheet goals. As more corporates weigh their own cryptocurrency programs, Strive’s progress—especially its transition to an unencumbered BTC position—adds to the dialogue about risk management, governance, and transparency in corporate crypto strategies.

For builders and policymakers, the episode raises questions about governance, disclosure, and the sustainability of treasury-centric models. If more companies pursue similar paths, there may be pressure to standardize reporting on crypto holdings, hedges, and debt instruments so markets can better assess risk and return profiles. The interplay between equity financings and crypto purchases, particularly in the face of regulatory shifts, will shape how such programs evolve in the coming quarters.

What to watch next

- Release of detailed use-of-proceeds statements from Strive regarding the SATA offering closing and allocation of funds.

- Monitoring the pace of debt repayment, including the remaining $10 million due within roughly four months.

- Any further Bitcoin purchases or changes to hedging strategies as the company manages liquidity and exposure.

- Regulatory developments affecting corporate crypto treasuries and disclosure requirements.

Sources & verification

- Strive’s public disclosures on debt retirement and the Semler Scientific acquisition, including the $110 million retirement and the $90 million convertible notes exchanged for SATA stock.

- Details of the SATA offering and its upsizing from $150 million to $225 million in response to roughly $600 million of demand.

- The completion of the Semler Scientific acquisition on Jan. 13 following the September merger agreement.

- The addition of 333.9 BTC at an average price of $89,851, bringing Strive’s total to 13,132 BTC, valued at about $1.17 billion.

- The reported 21.2% quarter-to-date Bitcoin yield and the status of Strive as a top-10 corporate BTC treasury holder.

- Industry-wide figures noting that more than 190 publicly traded companies hold Bitcoin on their balance sheets, collectively owning about 1.134 million BTC (roughly 5.4% of supply).

Bitcoin treasury expansion and debt retirement redefine Strive’s corporate treasury strategy

Strive’s financial moves this month mark a notable shift in how a corporate treasury can marshal capital to both deleverage and expand crypto exposure. By retiring a large portion of the debt it inherited from Semler Scientific and simultaneously increasing its Bitcoin holdings, the company is embedding digital assets more deeply into its core financial framework. The decision to use the proceeds from SATA to settle convertible notes and a Coinbase credit facility underscores a deliberate strategy to reduce liabilities while preserving ample liquidity for future buys. The unencumbered status of its Bitcoin portfolio stands out as a structural benefit, offering flexibility if market conditions or funding needs shift in the months ahead.

From a narrative standpoint, Strive’s approach blends traditional financing with crypto investment, signaling to investors that long-duration equity can serve as a bridge to balance-sheet optimization and asset accumulation. The upsized $225 million sale demonstrates investor appetite for instruments tied to Bitcoin exposure, provided the proceeds are channeled toward debt reduction and strategic acquisitions rather than amplified leverage. This combination matters because it could influence how other companies structure similar programs, particularly those seeking to weather volatility while building durable, crypto-linked revenue streams.

In practical terms, the retirement of the Coinbase loan and the conversion of $90 million of convertible notes into SATA stock illustrate a sophisticated approach to restructure liabilities in a way that clears the way for more aggressive asset accumulation without compromising financial stability. As corporate treasuries continue to emerge as a distinct asset class within the broader crypto ecosystem, Strive’s results may serve as a reference point for evaluating risk-adjusted returns, governance standards, and disclosure norms that will likely evolve as more firms explore Bitcoin’s role as a treasury asset.

https://www.cryptobreaking.com/strive-buys-bitcoin-pays-off/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Strive%20Buys%20Bitcoin,%20Pays%20Off%20Debt%20from%20Semler%20Scientific%20Deal%20

Comments

Post a Comment