Bitcoin Market Shows Signs of Bullish Momentum Amid Whales' Accumulation

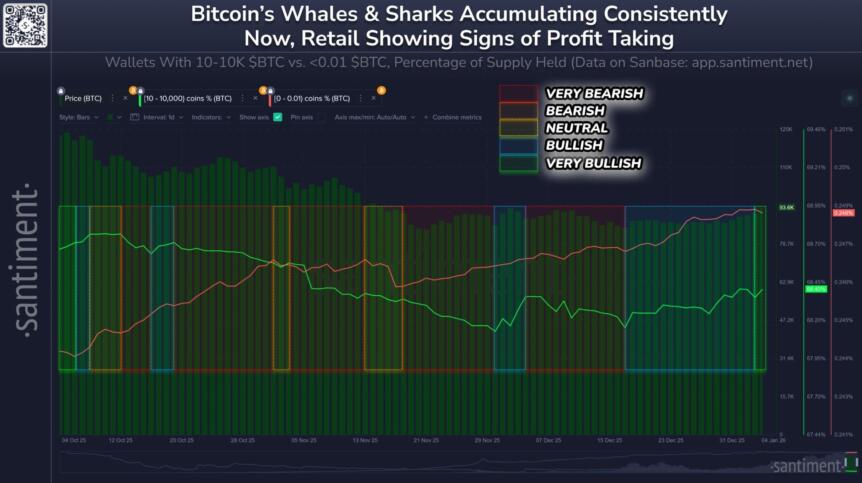

Recent analysis indicates a potentially bullish outlook for Bitcoin, driven by increased accumulation from large institutional-focused investors and profit-taking behavior among retail traders. On-chain data reveals that these dynamics could signal a shift towards further upward movement in the cryptocurrency market.

Key Takeaways

- Whale and shark addresses collectively added over 56,000 BTC since mid-December, indicating strong accumulation trends.

- Retail traders have been proactively taking profits, reflecting caution amid potential market traps.

- Bitcoin price remains rangebound but approaches crucial resistance levels, suggesting potential for a breakout.

- Market sentiment is leaning toward a higher probability of sustained capital growth in the near term.

Tickers mentioned: Bitcoin

Sentiment: Bullish

Price impact: Positive. The accumulation by whales and strategic profit-taking are fostering confidence in a potential upward movement.

Trading idea (Not Financial Advice): Hold. The current fundamentals and technical setup suggest a strong possibility of a breakout beyond key resistance levels, but caution remains advisable given the market's consolidation.

Market context: The broader crypto ecosystem continues to experience cautious optimism amid macroeconomic uncertainties, with on-chain activity serving as a leading indicator of trend shifts.

Market Analysis and Price Outlook

Bitcoin has maintained a sideways trading pattern over the past six weeks, oscillating between approximately $87,000 and $94,000 since November. The asset recently touched a high of $94,800 on Coinbase in late trading, marking a seven-week peak. This movement signals a potential breakout, especially as Bitcoin approaches the upper bounds of its recent trading range.

Expert analyst James Check notes that Bitcoin’s rally to $94,000 is supported by a significant redistribution of supply. The “top-heavy” supply has decreased sharply from 67% to 47%, which indicates a healthy rebalancing. Additionally, profit-taking has subsided considerably, and futures markets are showing signs of a short-squeeze. Despite these bullish signals, overall leverage in the market remains low, suggesting room for further upward movement.

Monitoring Key Resistance and Support Levels

Market participants view this phase as a bullish consolidation. Technical resistance is seen around $95,000 to $100,000, with notable interest in call options at the $100,000 strike for January expiry. Conversely, immediate support levels are identified between $88,000 and $90,000; a break below this range could trigger a deeper correction.

Overall, Bitcoin's current technical posture and on-chain activity suggest an optimistic outlook, with increased likelihood of a breakout that could propel prices higher in the coming weeks.

https://www.cryptobreaking.com/whale-accumulation-sparks-bullish-bitcoin/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Whale%20Accumulation%20Sparks%20Bullish%20Bitcoin%20Breakout—What%20It%20Means%20for%20Investors%20

Comments

Post a Comment