Ripple’s XRP Surges as Market Sentiment Turns Bullish

Ripple's native token, XRP, has recently garnered significant attention after a remarkable 25% increase in its price during the first week of the year. Market analysts and traders are increasingly viewing XRP as a rising star in the crypto landscape, driven by a confluence of institutional interest, social momentum, and renewed partnership developments.

Analysts highlight that XRP is outperforming major cryptocurrencies like Bitcoin and Ether, which have only seen modest gains of 6% and 10%, respectively, since the start of 2023. This rally is attributed to multiple factors, including bullish social sentiment and strong on-chain fundamentals, positioning XRP as a notable player this year.

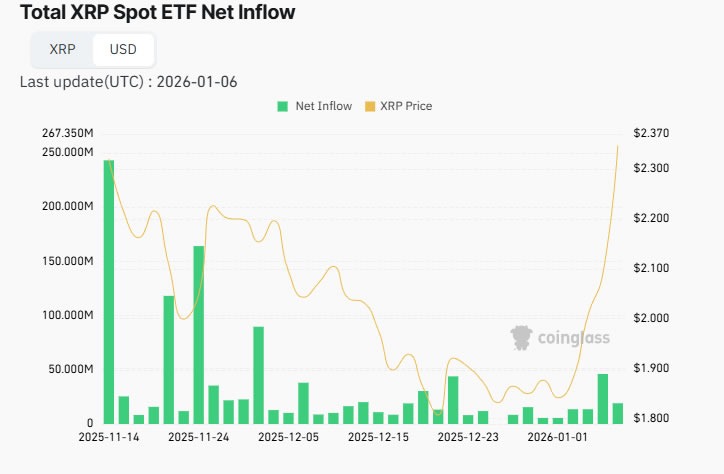

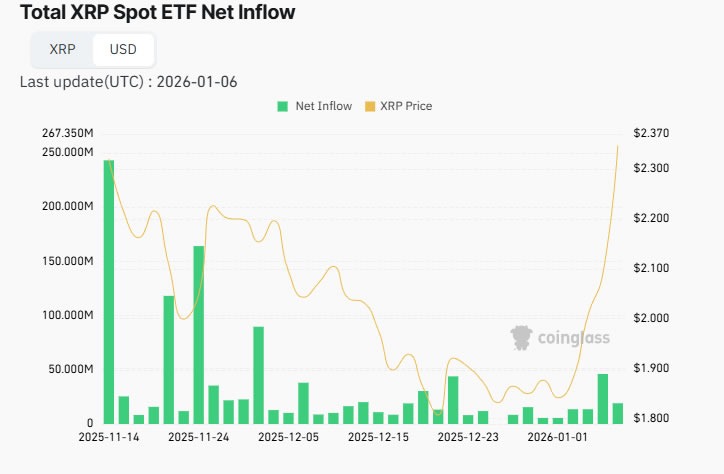

Growing ETF Interest Bolsters XRP's Momentum

Market observers point to the strong inflow into XRP-focused exchange-traded funds (ETFs) as a key driver of the rally. CNBC's Mackenzie Sigalos remarked that, contrary to typical trends seen with Bitcoin and Ether ETFs, investors heavily piled into XRP ETFs during Q4, capitalizing on lower prices and seeking less crowded trades. This trend has persisted into January, with nearly $100 million flowing into four dedicated XRP ETFs, bringing total inflows to over $1.15 billion without a single outflow day, according to data from Coinglass.

Positive Social Sentiment and On-Chain Activity

Market sentiment analysis further reinforces XRP's bullish outlook. AI-driven tools like Market Prophit report that both retail and institutional investors exhibit bullish confidence, supported by increased on-chain activity. New data indicates a sharp decline in XRP reserves held on Binance, reaching lows not seen in two years, suggesting reduced selling pressure.

Additionally, XRP's transaction volume and network activity have surged over 50% in recent weeks, signaling growing interest and engagement within its ecosystem.

Strategic Moves in Japan and Regulatory Developments

Ripple has accelerated its expansion efforts in Japan through partnerships with major financial institutions, including Mizuho Bank and SMBC Nikko, aiming to expand XRP Ledger adoption across the country. Moreover, Ripple received conditional approval from the US Office of the Comptroller of the Currency to establish Ripple National Trust Bank, a significant step toward broader banking integration.

Ripple President Monica Long commended the company’s recent funding round and valuation of $40 billion, emphasizing their strategic focus on growth rather than immediate plans for an IPO.

https://www.cryptobreaking.com/xrp-surges-past-bitcoin-as/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=XRP%20Surges%20Past%20Bitcoin%20as%20CNBC%20Declares%20It%20the%20New%20Crypto%20Favorite%20

Comments

Post a Comment