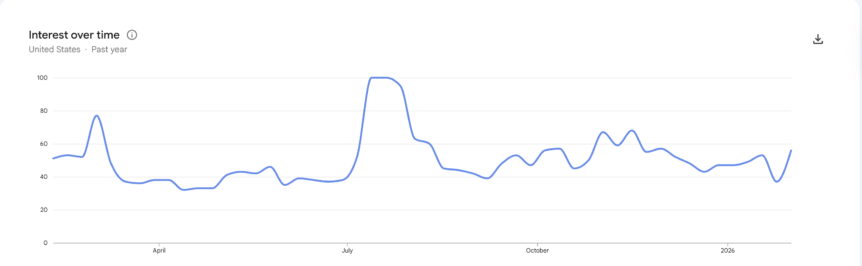

Google worldwide search volume for “crypto” is hovering near a one-year low as investor sentiment cools amid a broad market downturn that has trimmed the crypto market’s total capitalization from a peak above $4.2 trillion to roughly $2.4 trillion. The global Google Trends reading for crypto sits at 30 out of 100, with the 12-month high of 100 last reached in August 2025 when market fervor and valuations were at their peak. In the United States, the pattern mirrors the wider trend but with its own rhythm: after a July high of 100, US search interest dipped below 37 in January and then rebounded to 56 in the first week of February. Taken together, these metrics paint a cautious mood among retail and institutional participants alike.

Google search data has long been used by market observers as a proxy for investor interest and potential turning points, aligning with sentiment gauges such as the Crypto Fear & Greed Index. As liquidity has cooled and volatility has persisted, traders and long-term holders have faced a challenging environment where on-chain activity and capital flows tighten alongside waning enthusiasm for risk-on bets in the crypto space. The juxtaposition of dwindling searches with continuing headlines about market stress underscores a market that remains sensitive to macro headlines, policy signals, and evolving risk appetites.

Google search data is often used as a gauge of investor sentiment and corroborates other indicators that track crowd psychology across the crypto market. As the broader market contends with macro headwinds, retail chatter and social signals continue to reflect a cautious stance, even as some pockets of volatility persist.

Investor sentiment craters as Fear & Greed Index hits record lows

The Crypto Fear & Greed Index plunged to a record low of 5 on Thursday, before ticking up to 8 by Sunday, according to CoinMarketCap. Both readings sit in the “extreme fear” territory, signaling widespread risk aversion among market participants. The latest readings echo sentiment conditions observed during past downturns, including periods that followed the Terra ecosystem collapse and the associated de-pegging event in 2022. CoinMarketCap notes that extreme fear can coexist with abrupt bursts of selling pressure, creating environments where short squeezes and liquidity gaps become more pronounced.

In broader terms, sentiment has moved in lockstep with price action and liquidity constraints. The market’s mood now resembles the climate seen after the Terra collapse, when contagion fears and leverage-induced liquidations amplified downside pressure. The Terra incident, which destabilized the Terra ecosystem and its dollar-pegged stablecoin, remains a reference point for how quickly confidence can erode in a highly correlated sector. The event set in motion cascading liquidations that helped accelerate a protracted bear phase in 2022, a period that many participants say still informs risk management and portfolio construction today.

The dialogue around sentiment is also fed by data-driven signals from analysts tracking social conversations and on-chain indicators. Santiment has highlighted a sharp decline in positive versus negative commentary, with crowd sentiment skewing heavily negative as traders search for a bottom to time their entries. While some investors seek capitulation points as an opportunity to accumulate, others remain wary of premature bets in an environment where liquidity can tighten quickly and price swings remain pronounced.

The broader mood is reinforced by market structure data: daily aggregate crypto trading volume has fallen markedly from a high near $153 billion on Jan. 14 to around $87.5 billion most recently, underscoring the retreat in participation and the challenge of sustaining momentum in a risk-off regime. These shifts in activity, combined with sentiment indicators, paint a picture of a market that remains fragile and sensitive to macro catalysts and policy developments. Investors are paying closer attention to how institutions and retail players reposition their risk budgets in the face of ongoing volatility and mixed fundamentals.

Why it matters

At a fundamental level, the convergence of weak search interest, suppressed trading volumes, and extreme fear in sentiment indices matters for participants across the crypto ecosystem. For traders, the current environment reinforces the importance of risk controls, liquidity considerations, and disciplined position sizing, given the potential for rapid shifts if macro catalysts improve or if liquidity flows reaccelerate. For builders and developers, the mood underscores the need for clarity around use cases, real-world utility, and user acquisition strategies that can drive sustained engagement even when markets are challenged.

From a retail vantage point, the data suggest that casual interest is not being replaced by immediate price upside; rather, attention remains episodic, with bursts around major headlines and then a reversion to the mean. This dynamic can affect onboarding curves for new users and the cadence of education and tooling that platforms rely on to convert curiosity into participation. Meanwhile, for institutions, the subdued atmosphere might translate into more selective allocations, tighter diligence, and a wait-and-see posture as they gauge how the regulatory and macro landscapes unfold in the coming quarters.

The Terra episode remains a salient reminder of how quickly sentiment can flip when confidence erodes and liquidity drains. In such environments, risk models that emphasize stress-testing, collateral management, and scenario planning can be more valuable than outright exposure bets. Investors should remain mindful of the connections between search behavior, sentiment, and price action, recognizing that public interest can act as a leading indicator of potential market inflection—but not a reliable predictor on its own.

What to watch next

- Continuing Google Trends updates on crypto search interest (worldwide and US) to spot any turning points in public curiosity.

- Monitoring the Crypto Fear & Greed Index and related sentiment metrics on CoinMarketCap and comparable aggregators.

- Observing developments around Terra’s ecosystem and the future trajectory of LUNA, as well as any regulatory or governance signals affecting stablecoins and cross-chain liquidity.

- Watching liquidity dynamics and macro flows, including ETF-related product activity and institutional risk appetites, to gauge potential shifts in market participation.

Sources & verification

- Google Trends data for Crypto worldwide and US searches (Google Trends links in the article).

- CoinMarketCap Fear & Greed Index page for sentiment data.

- CoinMarketCap charts page for market volume trends.

- Terra ecosystem collapse coverage and its impact on market psychology and liquidity (2022 references cited in the article).

- Santiment research and weekly summaries on crowd sentiment and social signals.

Market reaction and key details

What the data collectively suggest is a crypto market that remains highly sensitive to macro dynamics, liquidity conditions, and high-profile narrative events. The decline from a peak market cap above $4.2 trillion to roughly $2.4 trillion reflects not only price moves but also a broad retrenchment in risk appetite and a retreat by weaker hands who fueled the late-2021 to mid-2025 hype cycle. The rebound in US search interest in early February indicates that public attention can snap back, but whether that translates into durable capital inflows remains uncertain. As one anchor of the ecosystem, Bitcoin (CRYPTO: BTC) continues to lead price discovery, even as broader market participation ebbs and flows in response to evolving fundamentals and sentiment.

Terra’s collapse and the subsequent liquidity shock provided a stark reminder of how correlated risk exposures can be, particularly when leverage is high and confidence deteriorates. The reverberations from that event still inform risk controls, governance discussions, and the pace at which new products attempt to attract capital in a cautious environment. In the near term, the market will likely hinge on macro signals, regulatory clarity, and the interplay between sentiment indicators and actual on-chain activity.

Why it matters (expanded)

For users and investors, the current climate underscores the importance of diversification, prudent risk management, and clear investment objectives. It also highlights the value of staying informed through reliable data sources and avoiding overreliance on short-term sentiment alone. For builders in the space, the message is to emphasize tangible use cases, security, and user-friendly tooling that can withstand periods of market stress. For the market as a whole, the ongoing scrutiny around liquidity, regulatory development, and institutional participation will shape the trajectory of adoption and the resilience of the sector to shocks.

Ultimately, the story is one of a maturing market that continues to wrestle with volatility, narrative risk, and the pace of innovation. As investors weigh risk-adjusted returns in a downbeat environment, the data offer a sober reminder: interest can surface quickly, but sustained participation requires credibility, resilience, and real-world utility that transcends cycles.

What to watch next

- Weekly updates on Google Trends for crypto and related terms to identify shifts in public interest.

- Monitoring the Fear & Greed Index for potential signals that market psychology is shifting toward a more constructive phase.

- Tracking Terra-related developments and the performance of its associated assets, including governance updates and liquidity restoration efforts.

Sources & verification

https://www.cryptobreaking.com/crypto-google-searches-plummet-to/?utm_source=blogger%20&utm_medium=social_auto&utm_campaign=Crypto%20Google%20Searches%20Plummet%20to%201-Year%20Lows%20Amid%20Market%20Crash%20

Comments

Post a Comment